AI Dashboards for VCs: Streamlining Due Diligence

AI dashboards automate data extraction, NLP analysis, and visual reporting to cut VC due diligence time, improve risk detection, and scale small teams.

Jan 18, 2026

AI tools are changing how venture capitalists evaluate deals, slashing time spent on manual tasks and improving decision-making.

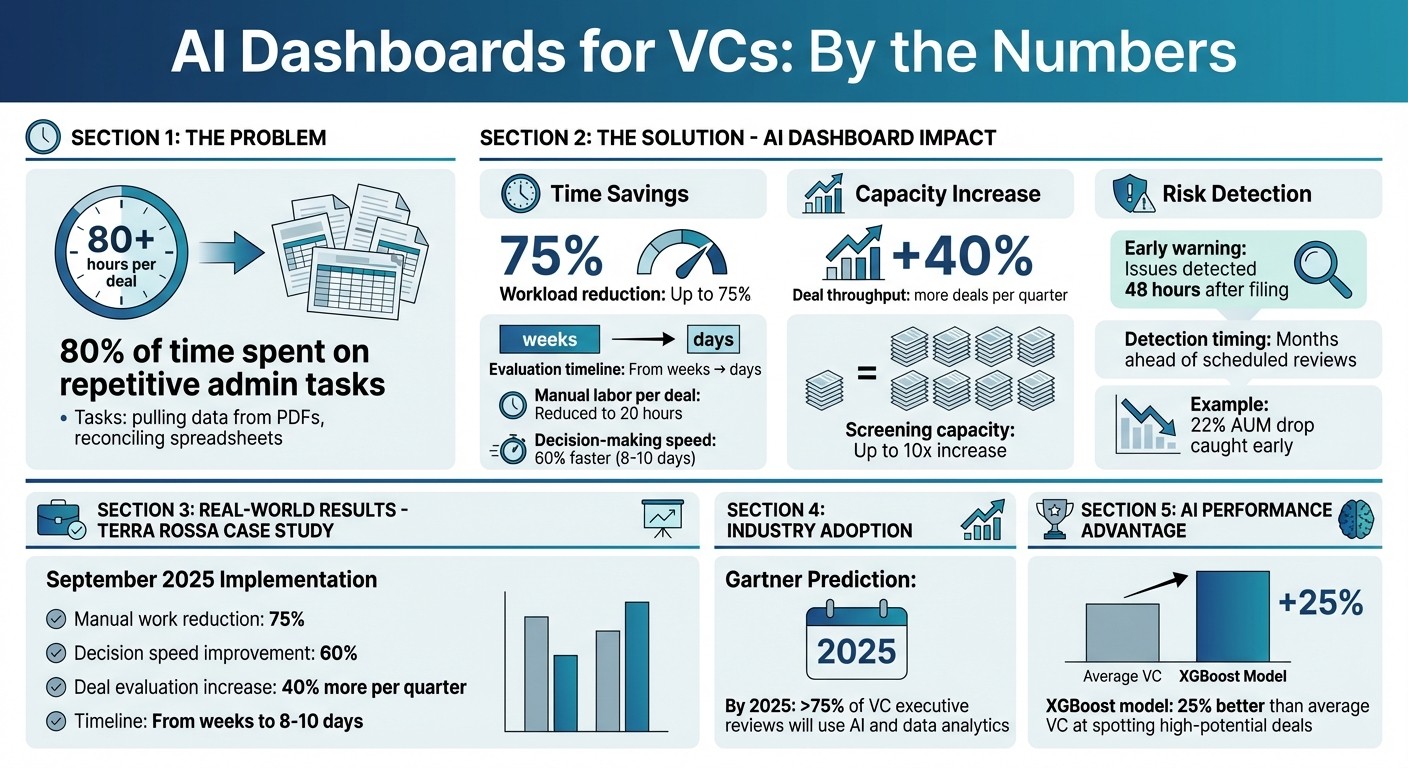

VC firms often spend over 80 hours analyzing a single deal, with 80% of that time consumed by repetitive admin tasks like pulling data from PDFs and reconciling spreadsheets. AI dashboards are automating these processes, reducing workloads by up to 75% and cutting evaluation timelines from weeks to days.

Here’s what these tools offer:

Automated Data Collection: Extract key metrics from unstructured documents like pitch decks and contracts.

Document Analysis with NLP: Spot inconsistencies and red flags in financial models or market claims.

Interactive Visualizations: Real-time dashboards track risks, metrics like ARR growth, and portfolio health.

Customizable Scoring Models: Standardized frameworks ensure consistent deal evaluations.

For example, Terra Rossa, a family office, adopted StratEngineAI in late 2025 and reduced deal review times by 60%, enabling them to evaluate 40% more deals each quarter.

The takeaway: AI dashboards are becoming essential for VCs to stay competitive, handle growing deal flows, and make faster, more reliable investment decisions.

AI Dashboard Impact on VC Due Diligence: Key Performance Metrics

Core Features of AI Dashboards for VCs

Automated Data Collection and Analysis

AI dashboards take the hassle out of gathering data from multiple sources. These tools automatically pull key figures, valuation methods, and financial terms from unstructured documents like pitch decks, PDFs, and side letters, transforming them into structured data that’s easy to compare [1][4]. Instead of spending hours plugging numbers into spreadsheets, analysts can focus on drawing meaningful insights.

The benefits are clear. For example, in November 2025, a global allocator used an automated dashboard to track regulatory filings, identifying that 10% of managers had overdue due diligence reviews [1][4]. By automating this previously manual task, the firm cut its planning time by 60% [1].

These dashboards also keep tabs on real-time regulatory changes, such as shifts in AUM, fee structures, or disciplinary disclosures [1]. In one case, an allocator spotted a 22% drop in AUM and a fee structure change in a manager’s filing within 48 hours - months ahead of the next scheduled review. This early detection allowed for a deeper investigation, avoiding potential surprises during board meetings [1].

Document Analysis Using Natural Language Processing

Natural language processing (NLP) has transformed how venture capitalists review documents. AI-powered systems scan pitch decks, contracts, and financial models to spot contradictions, red flags, and inconsistencies that might slip past a human reviewer during a quick read [6]. Advanced NLP tools can even identify misaligned market claims or conflicting milestones [6].

Take this example: a finance team used AI to extract valuation methodologies from 70 documents in just a few hours - a task that would typically take days or even weeks [1]. Beyond just pulling numbers, the system flagged discrepancies across documents and highlighted areas needing further scrutiny. As DiligenceVault aptly put it:

"The industry has moved beyond the era of manual data collection and into the era of AI-powered insight" [1].

StratEngineAI takes this a step further by creating traceable investment memos complete with source citations. This feature ensures that every claim can be verified against its original document, which is particularly important for compliance and transparency when presenting findings to investment committees [3][6]. This level of clarity and reliability accelerates due diligence processes across the board.

Together, these tools set the stage for dynamic, data-driven visualizations.

Interactive Visualizations and Reports

Once the data is collected and analyzed, interactive visualizations bring it to life. These dashboards replace static spreadsheets with real-time visuals and heatmaps that highlight multi-dimensional risks [1]. Modern AI dashboards score deals across various factors like operations, compliance, ESG, and cybersecurity, presenting the results in color-coded grids that make patterns easy to spot [1]. Investment committees can quickly identify which deals need immediate attention and which are performing well.

The utility of these visualizations extends to portfolio monitoring, too. Real-time KPI dashboards track metrics like MRR/ARR growth, customer acquisition costs, burn rates, and runway projections, automatically updating as new data comes in [2]. Workflow trackers further enhance efficiency by measuring turnaround times for both internal teams and external managers, helping firms manage workloads during busy deal cycles [1].

Dashboard Type | What It Tracks | Impact on Due Diligence |

|---|---|---|

ADV & Regulatory Filings | AUM declines, fee changes, disciplinary actions | Detects red flags well before scheduled reviews [1] |

Structured Diligence Data | Side-by-side comparisons of fees, ESG criteria, and LP terms | Enables consistent evaluation across vintages and sectors [1] |

Automated IC Memos | Insights from pitch decks and data rooms | |

Portfolio KPI Health | MRR/ARR growth, CAC, burn rate, runway | Delivers predictive alerts for deviations from projections [5] |

The outcome? Teams gain clarity without being overwhelmed by sheer data volume, allowing them to focus on what matters most.

Benefits of AI Dashboards in Due Diligence

Faster Deal Screening and Evaluation

AI dashboards have transformed the pace of deal screening, turning what used to take weeks into a matter of days. Take the example of Terra Rossa, a family office that, in September 2025, adopted StratEngineAI's Due Diligence Copilot (DDC) to address workflow bottlenecks. By leveraging this tool, they slashed manual labor by 75%, reducing it to just 20 hours per deal. On top of that, they sped up decision-making by 60%, bringing timelines down to 8–10 days. This newfound efficiency enabled them to evaluate 40% more deals per quarter [4].

The secret lies in automating tasks that once required tedious manual effort. AI tools handle processes like data extraction, verifying consistency across slides, and drafting investment committee memos - all with remarkable speed. Instead of poring over pitch decks and financial models, analysts can rely on AI agents to extract key metrics, flag inconsistencies between market claims and financial data, and generate polished, source-cited reports in minutes [5][6]. For example, one XGBoost model used in startup evaluations even outperformed the average venture capitalist by 25% in spotting high-potential deals [10]. As OakTech Systems aptly puts it:

"AI isn't replacing the judgment of seasoned investors. What it does is take the manual grind off the table." [4]

This newfound speed blends seamlessly with risk assessment processes, making due diligence faster and more thorough.

Improved Risk Detection

When it comes to spotting risks, AI dashboards outperform traditional manual reviews. These tools are adept at scanning legal and financial documents, detecting non-standard terms, compliance issues, and hidden red flags that might escape human analysts during a quick review [5]. They also act as early-warning systems, monitoring regulatory filings in real time to catch potential issues before they escalate.

Dynamic heatmaps are another game-changer. These visual tools score deals across areas such as operations, compliance, ESG, and cybersecurity, making it easier to identify irregularities and patterns [1]. By applying a standardized evaluation framework to every deal, AI minimizes subjective human bias and ensures consistency across analysis teams [4][10]. In fact, Gartner predicts that by 2025, over 75% of venture capital and early-stage investor executive reviews will rely on AI and data analytics [7]. This growing reliance on AI tools highlights their role in enabling more rigorous and balanced risk assessments, which are essential for lean VC teams aiming to optimize their processes.

Scaling Capabilities for Small VC Teams

For small venture capital teams, limited resources can be a significant challenge. AI dashboards help bridge this gap by acting as an "intelligence layer" that automates time-consuming workflows, from initial deal teasers to final closures [5]. This allows analysts to focus on high-impact decisions instead of administrative tasks. The results are striking - AI-powered platforms can boost deal screening capacity by as much as 10x [5].

This operational efficiency allows even a two-person team to handle the volume of deals that would typically require a much larger staff. Instead of juggling scattered spreadsheets and email chains, centralized dashboards provide real-time visibility into all active reviews, highlighting bottlenecks and delays [1]. As OakTech Systems emphasizes:

"The firms that win the next decade won't just be the ones with the best networks or the most capital. They'll be the ones that adopt smarter, more scalable ways of evaluating opportunities." [4]

Adding AI Dashboards to VC Workflows

Connecting with Existing Systems

AI dashboards today are designed to work seamlessly with the tools you're already using. They integrate directly with CRMs, virtual data rooms, and fund administration systems - no need to migrate data or abandon your trusted platforms [5][3].

Using APIs, these dashboards automatically sync with deal-flow systems, meeting platforms like Zoom and Microsoft Teams, and productivity tools such as Google Workspace or Microsoft 365 [8]. This eliminates the hassle of jumping between tools during tasks like screening or due diligence, streamlining your workflow.

The result? A centralized dashboard that pulls together scattered data - emails, spreadsheets, filings, and pitch decks - into one place. This consolidated view not only saves time but also sets the stage for dashboards that can be customized to align with your firm's investment strategy.

Customizing Dashboards for Your Investment Strategy

Every firm has its own approach to investing, and generic dashboards often fall short of meeting those specific needs. The best AI dashboards allow for customization, enabling you to adjust scoring models, metrics, and evaluation frameworks to reflect your risk preferences and sector focus [4][1].

Starting with standardized evaluation criteria ensures consistency across all deals, making it easier to compare opportunities and reduce subjective bias. From there, a phased approach to customization works best. Begin with impactful automations like contract analysis or parsing financial statements, then expand to more comprehensive workflows [9]. This gradual rollout helps you identify which features bring the most value to your processes while building trust in the system.

Once customized, these dashboards also make it easier to maintain clear audit trails - essential for ensuring accountability in decision-making.

Maintaining Transparency and Audit Trails

AI dashboards go beyond automating data collection - they create detailed audit trails that track every step of the decision-making process. For investment committees and limited partners, this means having access to traceable insights that clearly show where data came from and how conclusions were reached. Many advanced platforms even generate memos with source citations that link directly to data room pages [5].

Transparency doesn’t stop there. Features like version control and access logs record every change to inputs or assumptions, ensuring compliance with regulatory requirements and meeting the reporting needs of LPs [9][3]. Some dashboards also provide confidence scores, helping analysts identify which AI-generated recommendations might require a closer look.

Real-time monitoring adds another layer of oversight. For example, these dashboards can track regulatory filings and flag changes - such as shifts in assets under management or fee structures - within 48 hours. This serves as an early-warning system, helping firms uphold their fiduciary responsibilities [1]. By combining traceable data, proactive monitoring, and institutional-grade rigor, AI dashboards deliver the transparency and reliability that investment committees demand.

Measuring AI Dashboard Performance

Metrics for Tracking Success

Once you've streamlined integration and tailored your AI dashboard, the next step is to measure its performance. Evaluating these tools helps quantify their impact on operations, decision-making, and overall efficiency. Start by setting benchmarks before implementation - track metrics like current cycle times, lead-to-opportunity conversion rates, and hours spent manually on each deal [11].

One critical metric is time savings per deal. AI platforms often cut manual work by 75%, speed up decision-making by 60%, and boost deal throughput by 40% each quarter [4][5]. In some cases, firms have seen their screening capacity grow by as much as tenfold [5].

Risk detection is another key area to monitor. Pay attention to how often your dashboard flags potential issues like regulatory risks, declines in assets under management (AUM), or changes in fee structures before they snowball. For instance, one system detected a 22% AUM drop months ahead of a scheduled review [1]. Additionally, track decision consistency - standardized frameworks ensure analysts apply the same criteria, making evaluations comparable across the board [4][6].

The following case study highlights how these metrics come to life.

Case Study: How StratEngineAI Improves Due Diligence

StratEngineAI addresses a major pain point in venture capital workflows: screening pitch decks and generating investment memos. By analyzing over 50 startup metrics - such as market clarity, competitive positioning, and growth potential - the platform delivers results in minutes instead of hours [11].

One standout feature of StratEngineAI is its traceable investment memos. Every insight is linked to its source data, ensuring clear audit trails that investment committees and limited partners can trust. This transparency not only accelerates deal flow but also boosts confidence in the analysis. Moreover, the platform incorporates over 20 strategic frameworks - like SWOT analysis, Porter’s Five Forces, and Blue Ocean Strategy - to ground its recommendations in proven methodologies.

For VC teams juggling a growing number of deals without adding staff, StratEngineAI transforms the labor-intensive "teaser-to-close" process into a streamlined workflow [1][11]. While partners still weigh in on qualitative aspects like team dynamics, the platform takes care of the heavy quantitative analysis, freeing up time for relationship-building and strategic contributions.

Long-Term Advantages for VC Firms

The earlier metrics show how AI dashboards not only enhance speed but also provide deeper strategic insights. As DiligenceVault aptly put it:

"The teams that will win in 2026 are not the ones collecting the most data; they are the ones interpreting it best and acting first." [1]

AI dashboards empower smaller teams to compete with larger firms by managing higher deal volumes without compromising on evaluation quality. This scalability becomes a strategic advantage. As your portfolio expands, AI tools monitor key performance indicators (KPIs) across investments, flagging deviations from projections and offering predictive alerts to enable proactive responses [5][9]. Over time, you can refine your models by backtesting them against past outcomes, improving how effectively your AI identifies high-potential deals [10].

Early adoption of AI dashboards helps firms build a data-driven approach that strengthens over time. Each completed deal enriches your knowledge base, sharpening your models and enhancing decision-making. In an industry where speed and accuracy open doors to the best opportunities, this kind of edge can make all the difference.

Conclusion: AI's Impact on VC Due Diligence

The venture capital landscape is evolving rapidly. By 2025, it's projected that over 75% of VC executive reviews will rely on AI and data analytics [7]. This shift is already making waves, with firms adopting AI-powered tools to enhance both speed and precision in their decision-making processes.

Take Terra Rossa, for example. This family office managed to cut down manual data tasks by 75%, reducing deal review timelines from weeks to just days [4]. As a result, they increased the number of deals reviewed each quarter by an impressive 40%.

Then there’s StratEngineAI, which takes automation to the next level. It screens pitch decks and produces detailed, traceable memos based on more than 20 strategic frameworks. This ensures high-quality analysis and establishes clear audit trails. For VC teams juggling an ever-growing deal flow without adding more staff, tools like this are becoming essential to stay competitive.

In today’s fast-paced market, speed and insight are everything. Automating repetitive tasks allows analysts to focus on high-value activities, such as refining strategies and assessing risks.

Adopting AI isn’t just a choice anymore - it’s a necessity. The question isn’t whether firms should embrace AI-powered dashboards but how quickly they can implement them. Those who invest in data-driven diligence now are setting themselves up to thrive in an increasingly competitive venture capital environment.

FAQs

How can AI dashboards speed up due diligence for venture capitalists?

AI dashboards simplify the due diligence process by bringing all critical data into one place, automating the extraction of key metrics, and offering real-time visual analytics. This eliminates the need for manual data handling, enabling venture capitalists to assess deals more quickly and efficiently.

With repetitive tasks automated, these tools can cut due-diligence timelines by as much as 75%, allowing VCs to screen a larger volume of deals. This approach frees up time for deeper analysis, ensuring decisions remain thorough and backed by data.

How does NLP help VCs analyze documents during due diligence?

Natural Language Processing (NLP) is a game-changer for venture capitalists (VCs) when it comes to sorting through unstructured text in documents like pitch decks, contracts, and financial reports. It can automatically pull out key metrics, flag potential risks, and even create concise summaries that are perfect for investment memos.

By automating these tasks, NLP does more than just save time - it ensures critical insights aren’t missed. This allows VCs to make quicker, well-informed decisions during the due diligence process.

How do AI dashboards help small VC teams streamline due diligence?

AI dashboards are transforming how small VC teams operate by taking over tedious tasks like data extraction and analysis. This shift frees up time for teams to zero in on what really matters - making sharper, faster investment decisions. With real-time visibility into deal pipelines, these tools make it easier to track progress and juggle multiple opportunities without missing a beat.

What’s more, AI dashboards provide consistent, data-backed insights, allowing VCs to evaluate deals faster without cutting corners. For smaller teams, this means they can scale up their operations, manage a higher volume of deals, and make decisions with greater confidence - all while conserving precious time and resources.