AI for VC Due Diligence: Risk Analysis Guide

AI-driven due diligence for VCs: automate document review, risk scoring and predictive models to uncover financial, technical, legal, and team risks faster.

Jan 18, 2026

AI is reshaping how venture capital firms evaluate startups. By automating time-consuming tasks like document reviews, financial analysis, and risk assessments, AI enables faster, more accurate investment decisions. With over $300 billion in available capital and only 1 in 400 startups securing funding, the pressure to evaluate opportunities efficiently is higher than ever.

Key Benefits of AI in VC Due Diligence:

Time Savings: AI reduces due diligence time by up to 60%.

Risk Detection: Identifies red flags in financials, market trends, and legal documents.

Objective Analysis: Minimizes human bias with consistent evaluation criteria.

Predictive Insights: Uses machine learning to forecast risks and outcomes.

AI’s Role in Main Risk Areas:

Financial Risks: Highlights issues like margin compression or client overdependence.

Market Risks: Assesses competition and market size using unstructured data.

Technical Risks: Evaluates code quality, scalability, and compliance.

Team Risks: Analyzes founder backgrounds and operational efficiency.

Legal & ESG Risks: Flags legal issues, IP gaps, and sustainability concerns.

AI-driven frameworks, such as 15-point risk evaluations and weighted scoring matrices, help VCs standardize decisions while keeping processes scalable. Although AI handles data-heavy tasks, human expertise remains essential for nuanced judgments like team dynamics and leadership potential.

The future of venture capital lies in combining AI’s analytical power with human decision-making to streamline workflows and improve investment outcomes.

How AI is Revolutionizing Private Equity Due Diligence | ToltIQ's Journey from KKR to Innovation

Main Risk Categories in VC Due Diligence

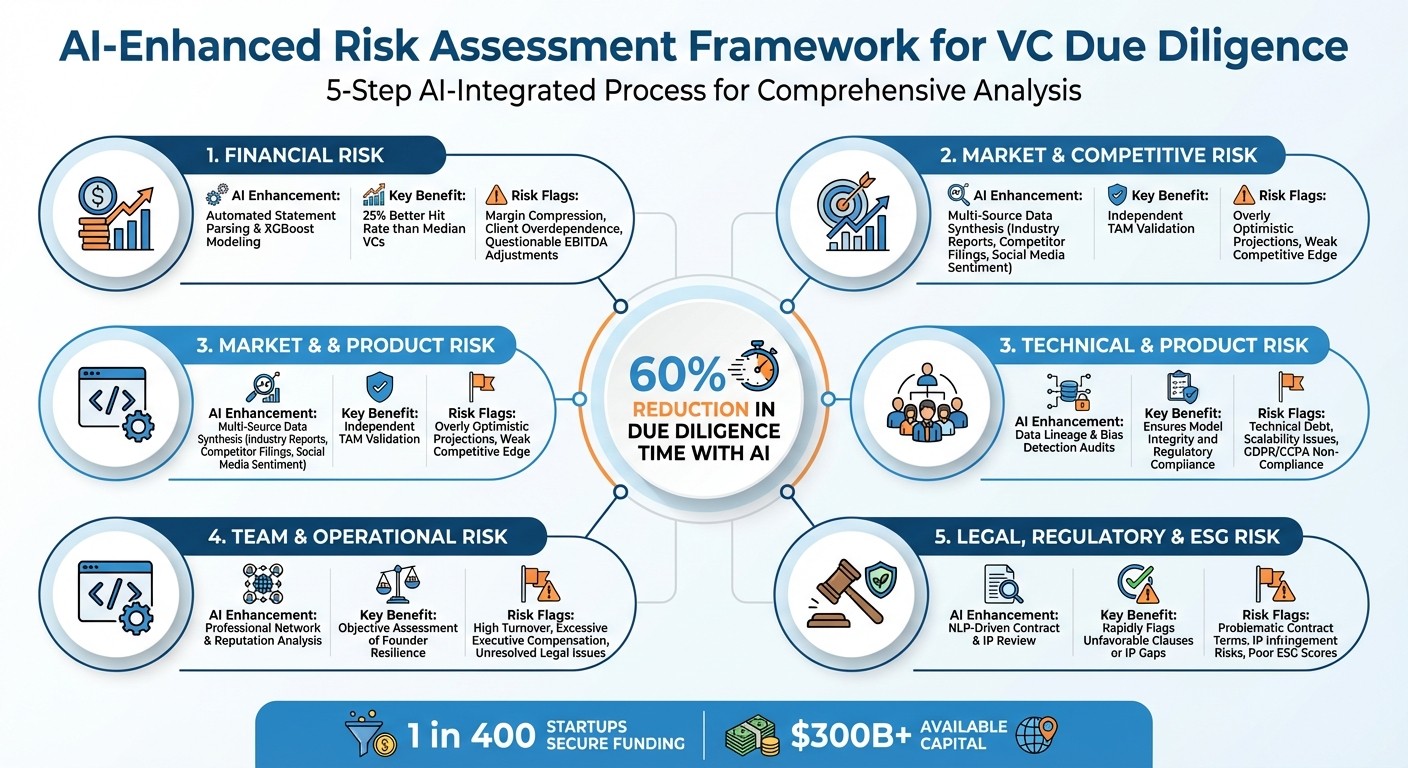

AI-Enhanced Risk Assessment Framework for Venture Capital Due Diligence

Venture capitalists typically focus on five key risk areas when evaluating potential investments. AI has revolutionized this process by performing deep analyses and uncovering patterns that might escape human reviewers. Tasks that used to take weeks - such as reviewing financial statements, scanning patent databases, or analyzing founder backgrounds - can now be completed in minutes with AI.

Given the slim odds of securing funding, detecting early warning signs is critical. AI stands out by applying consistent evaluation criteria across all deals, avoiding the subjective judgment calls that can lead to missed opportunities or poor decisions. Let’s break down how AI reshapes each of these risk categories.

Financial Risk Assessment

AI has transformed how investors assess a startup's financial health. By standardizing financial data, it quickly identifies red flags like margin compression or unsustainable spending. AI can also highlight risks founders might try to downplay, such as an overdependence on a few clients or questionable EBITDA adjustments [1][2].

Beyond identifying issues, AI uses historical data and market trends to generate predictive forecasts. For example, an XGBoost machine learning model has been shown to outperform the average venture capitalist by 25% in screening potential investments [6]. This allows analysts to focus less on reconciling conflicting financial reports and more on strategic questions about the startup’s business model and growth potential.

Market and Competitive Risk Analysis

Assessing a startup's total addressable market (TAM) is notoriously challenging, as founders often present overly optimistic projections. AI provides a more grounded perspective by synthesizing data from multiple sources - industry reports, competitor filings, social media sentiment, and news coverage - to create an independent view of market size and competition [1][3].

AI shines in analyzing unstructured data, which traditional methods often struggle with. It can track mentions of competitors in technical blogs, monitor customer sentiment on social media, and identify potential threats from adjacent markets. This comprehensive approach helps investors determine whether a startup’s competitive edge is genuine or merely a marketing claim [3].

Technical and Product Risk Evaluation

Technical due diligence requires precision, and AI simplifies this process by evaluating technical debt, code quality, and scalability. By analyzing cloud architecture and development practices, AI helps investors determine whether a product can scale without requiring costly rewrites - a mistake that has derailed many startups [4][1].

For startups focused on AI, the scrutiny goes further. Investors use AI to audit a company’s own AI systems, examining the sources of training data, strategies for mitigating bias, and compliance with privacy regulations like GDPR and CCPA [4]. This ensures the startup’s technology is built on a solid foundation that can withstand regulatory and public scrutiny.

Team and Operational Risk Assessment

Assessing founders and their teams has traditionally involved subjective judgment, but AI brings more objectivity to the table. By analyzing professional networks and public data, AI evaluates founder backgrounds, leadership styles, and team dynamics [4][1]. It can uncover red flags, such as unresolved legal issues from past ventures, or inefficiencies that hint at poor management.

AI also evaluates operational efficiency by analyzing data like burn rates, hiring patterns, and resource allocation. It can flag concerning trends, such as excessive executive compensation or high turnover in critical roles - issues that often signal deeper operational challenges.

Legal, Regulatory, and ESG Risks

Natural Language Processing (NLP) has revolutionized legal due diligence. AI tools can now scan incorporation documents, shareholder agreements, and contracts to identify problematic terms, such as exclusivity clauses or termination penalties, that could limit a company’s flexibility [1][2]. These tools provide detailed traceability, linking flagged issues directly to the source documents [2][3].

Intellectual property (IP) verification has also seen significant improvements. AI scans global patent databases and regulatory filings to ensure a startup’s IP portfolio is valid and defensible [4]. It can even identify potential infringement risks by comparing patents against competitors in real time.

Environmental, social, and governance (ESG) factors have become standard in due diligence. AI evaluates areas like energy consumption (especially for compute-heavy models), leadership diversity, and ethical AI practices to generate risk scores [4][1]. For startups developing high-impact algorithms, AI looks for warning signs such as the absence of an ethical AI committee or excessive energy use without a clear plan for optimization [4].

Risk Category | AI Enhancement Method | Key Benefit |

|---|---|---|

Financial | Automated statement parsing & XGBoost modeling | 25% better hit rate than median VCs [6] |

Technical | Data lineage & bias detection audits | Ensures model integrity and regulatory compliance [4] |

Legal | NLP-driven contract & IP review | Rapidly flags unfavorable clauses or IP gaps [1] |

Team | Professional network & reputation analysis | Objective assessment of founder resilience [1] |

AI Frameworks and Methods for Risk Analysis

To shift from subjective decision-making to reliable, AI-powered insights, venture capital firms are adopting structured frameworks for risk analysis. These frameworks align with AI's ability to streamline due diligence while maintaining thoroughness. The main challenge they address? Processing hundreds of deals monthly without needing to massively expand teams.

Data Quality and Governance Standards

The reliability of AI hinges on the quality of the data it processes. Low-quality data can lead to "model drift", where AI predictions become less accurate over time due to outdated or biased inputs. Strong governance practices are essential to keep risk assessments accurate and dependable throughout the deal process.

Source verification is the cornerstone of data quality. Every data point should trace back to a verified source, such as audited financial reports, regulatory filings, or authenticated API feeds. This level of documentation is vital for justifying investment decisions to limited partners or when AI flags unexpected risks.

Bias detection and correction are equally critical. Without regular audits, AI systems might undervalue nontraditional founders or fail to recognize emerging market opportunities. Routine checks on model outputs help identify and address these issues [4][6].

Data lineage documentation ensures that every flagged risk can be traced back to its original source. For instance, if the AI highlights a problematic shareholder agreement clause or an unusual burn rate, it should clearly cite the document or data point that triggered the alert. This transparency helps prevent reliance on inaccurate AI outputs, often referred to as "hallucinations" [4][2].

Privacy compliance is another key area. Measures like zero-day retention agreements, which delete sensitive data immediately after analysis, and certifications such as SOC and ISO, ensure that confidential information remains secure and isn’t unintentionally exposed to public AI models [10][2].

"The trajectory hinges on data quality, vendor interoperability, and disciplined governance that prevents model drift and data leakage." - Guru Startups [10]

Once data integrity is secured, the next step is applying a structured evaluation framework.

15-Point AI Risk Evaluation Framework

Building on strong governance principles, the 15-point framework organizes risk analysis into actionable categories. This checklist covers technical, operational, and ethical aspects of AI risks [4]. Each point targets a specific area, from data quality and integrity (ensuring proper verification) to AI governance and ethics (evaluating transparency and oversight). It also examines model architecture and performance (validating accuracy and robustness), technical infrastructure (cloud security and scalability), and founder expertise (assessing real AI/ML knowledge versus marketing buzzwords) [4].

Financial and market considerations are equally emphasized. The framework looks at unit economics (like compute and data costs), market positioning (to evaluate competitive advantages), and customer validation (using analytics instead of surface-level metrics). Legal and regulatory concerns also play a role, assessing intellectual property risks, compliance with emerging AI regulations, and ESG factors such as energy consumption for compute-intensive models [4].

In 2025, Rebel Fund showcased the power of structured frameworks through its proprietary "Rebel Theorem" ML algorithm. Trained on millions of data points from nearly 200 Y Combinator startups, this approach allowed the fund to create one of the most detailed datasets of YC startups outside of Y Combinator itself. This data-driven method enabled pattern recognition that would have been impossible through manual analysis [4].

The framework operates through defined stages:

Initial Screening: Reviews market size and team credentials.

Deep Technical Review: Focuses on data quality and model performance.

Commercial Validation: Evaluates unit economics and customer feedback.

Final Decision: Synthesizes legal reviews into the investment thesis [4].

Eximius Ventures, for example, uses this phased approach to manage 800–900 pitches monthly - representing about 90% of India’s seed market - with just five team members. Their AI-powered deal funnel automates initial filtering and scoring, allowing human analysts to step in later. This structured method enables small teams to handle large volumes efficiently [9].

15-Point Framework Category | Primary Assessment Focus |

|---|---|

Data Quality & Integrity | Source verification, bias detection, data freshness |

Model Architecture | Accuracy metrics, robustness testing, scalability |

Technical Infrastructure | Cloud security, API design, disaster recovery |

Team Competency | Founder AI/ML expertise, ethical leadership |

Market Positioning | Unique value proposition, competitive advantages |

Financial Validation | Unit economics, burn rate, compute costs |

Intellectual Property | Patents, trade secrets, open-source dependencies |

Regulatory Compliance | Adherence to GDPR, CCPA, and new AI laws |

ESG & Sustainability | Energy efficiency, fairness in algorithms |

Customer Validation | Churn rates, product-market fit indicators |

Vendor Ecosystem | Dependencies on critical cloud/AI providers |

Operational Excellence | QA protocols, deployment maturity |

Legal Review | Liability terms, IP ownership, equity structures |

Exit Strategy | Acquisition potential, IPO readiness |

AI Governance & Ethics | Transparency structures, bias monitoring |

Source: [4]

AI-Driven Automation in Due Diligence

AI-powered automation is transforming the due diligence process by making it faster and more efficient. Tasks that used to take analysts weeks - like document reviews and risk assessments - are now streamlined through advanced systems. These tools not only analyze historical data but also predict future risks, creating a more dynamic and proactive approach to due diligence.

Document Analysis and Risk Flagging

AI tools can now scan pitch decks, financial statements, and legal contracts to pull out critical metrics and flag potential risks. For instance, they can identify issues like high client concentration or unexplained drops in profit margins automatically [1][6]. Multi-LLM (multi-large language model) systems go a step further by evaluating multiple factors at once, such as the clarity of a startup's value proposition and the strength of its competitive edge, saving considerable time for analysts [3].

Technologies like natural language processing (NLP) and optical character recognition (OCR) further enhance this process. NLP can sift through unstructured data like contracts to identify problematic clauses, while OCR transforms PDFs into structured, searchable data [8]. This combination allows for red-flag detection across thousands of pages, a task that would otherwise be overwhelming for human reviewers. As Artur Haponik, CEO & Co-Founder of Addepto, explains:

"AI-powered due diligence doesn't just save time; it makes the entire process more accurate and objective" [1].

By 2025, it's anticipated that over 75% of venture capital and early-stage investor reviews will be influenced by AI and data analytics [5]. This shift not only reduces human bias but also ensures a consistent approach to evaluating deals [6]. While automated systems highlight current red flags, predictive models take it a step further by anticipating future risks.

Predictive Risk Modeling

AI doesn't stop at document reviews; it uses historical data and machine learning to forecast potential outcomes. These predictive models calculate scenarios like time-to-close probabilities, expected dilution ranges, and the chances of term-sheet disagreements [7]. For example, an XGBoost model used for screening startups outperformed the average venture capitalist by 25% [6].

These models are adept at spotting both "hard" risks, like inconsistent revenue growth, and "soft" risks, such as rising customer churn or reliance on a single key individual [7][2]. Specialized sub-agents extract relevant data points to create a detailed risk profile [2]. Unlike traditional static analyses, these systems continuously update risk scores as new data becomes available, enabling ongoing and dynamic monitoring [7].

Industries that have embraced AI integration report three times more revenue per employee compared to those that lag behind [6]. By surfacing the most critical insights, AI doesn't replace human judgment - it enhances it, ensuring that decision-makers can focus on what truly matters.

Building Risk Scoring and Decision Frameworks

After AI identifies potential risks, the next step is turning those insights into actionable decisions. A risk scoring system helps standardize evaluations across various deals, ensuring a balance between efficiency and thoroughness.

This process builds on AI-driven analyses by transforming raw data into structured, actionable insights.

Weighted Risk Scoring Matrices

A weighted risk matrix assigns specific importance to different risk categories. For instance, a typical AI-driven framework might distribute weights like this: Technical Risk (25%), Market Risk (20%), Team Risk (20%), Financial Risk (15%), Regulatory Risk (10%), and ESG Risk (10%) [4]. Each category is scored on a scale of 1 to 5, with the weighted scores combined into an overall risk score.

Take Rebel Fund as an example. They use their proprietary "Rebel Theorem" machine learning algorithm, trained on millions of data points, to identify promising startups. By 2025, Rebel Fund has invested in over 250 Y Combinator portfolio companies, collectively valued in the tens of billions of dollars [4]. This kind of standardization ensures consistent evaluations across opportunities.

Modern AI platforms also provide confidence-scored outputs, which indicate how reliable each risk signal is before being included in the matrix [3]. As Guru Startups puts it:

"The strongest tools function as trusted copilots that complement human expertise, maintain governance discipline, and demonstrably shorten the time-to-decision without compromising risk controls" [3].

Here’s a sample AI-driven risk scoring matrix:

Risk Factor | Weight | Score (1–5) | Weighted Score |

|---|---|---|---|

Technical Risk | 25% | 3 | 0.75 |

Market Risk | 20% | 2 | 0.40 |

Team Risk | 20% | 1 | 0.20 |

Financial Risk | 15% | 3 | 0.45 |

Regulatory Risk | 10% | 4 | 0.40 |

ESG Risk | 10% | 2 | 0.20 |

Total Risk Score | 100% | – | 2.40 |

Example of a weighted risk scoring matrix [4]

These scores help establish clear decision thresholds, making the evaluation process more transparent and actionable.

Setting Go/No-Go Decision Thresholds

Once the weighted scoring is complete, thresholds are set to guide decision-making - whether to move forward, pause, or walk away from a deal. Many firms use a four-stage gating process to filter deals systematically: Initial Screening, Deep Technical Review, Commercial Validation, and Final Investment Decision [4]. AI tools like pitch deck analysis and technical debt audits are mapped to specific stages of this review process [4].

Thresholds are tailored to each firm's risk tolerance. Deals with low risk scores may move quickly through the pipeline, while high scores often lead to rejection. For borderline cases, human judgment steps in to assess qualitative factors like team dynamics or leadership potential [6]. For instance, Bessemer Venture Partners has invested over $1 billion into AI-native startups since 2023 by leveraging predictive models to discover hidden opportunities with significant breakout potential [6].

While AI excels at providing objective, data-driven insights, human expertise remains critical for addressing complex qualitative factors. This partnership between AI and human judgment ensures a balanced approach to decision-making, blending precision with experience.

Best Practices for AI-Augmented Due Diligence

Bringing AI into due diligence workflows requires a balanced approach that blends automation with human insight. The aim isn't to replace human judgment but to streamline processes and uncover insights more efficiently. With over 75% of venture capital reviews now incorporating AI and data analytics, adopting a strategic implementation plan is more critical than ever [5].

To make the most of these advancements, start by auditing your workflow to identify tasks suitable for automation [2]. Repetitive tasks like document classification, administrative data entry, and initial pitch deck reviews are prime candidates for AI. By automating these, you can significantly speed up due diligence efforts. A phased rollout works best - begin with sourcing and screening, move on to document reviews in data rooms, and finally integrate AI into portfolio monitoring [10]. This step-by-step approach reduces disruption and helps teams build trust in the technology over time.

Leverage "audit mode" features to ensure AI-generated insights are directly linked to their source documents [2]. This traceability addresses concerns about AI errors and builds confidence in the findings. For technical claims flagged by AI, always verify them through independent expert networks and thorough reference checks [4]. As Kshitiz Agrawal of Qubit Capital aptly notes:

"The best process is human plus machine, not machine alone" [6].

Clearly define the roles of AI and humans in your workflow. AI is highly effective at processing large volumes of data - summarizing documents, extracting metrics, identifying inconsistencies, and populating standardized risk matrices [1][6]. However, humans remain indispensable for qualitative evaluations, such as assessing team dynamics, leadership potential, and founder resilience [1][6]. In fact, 88% of companies reported using AI in at least one business function in 2024, up from 78% the previous year, highlighting the rapid adoption of these tools across industries [6]. Despite AI's capabilities, the ultimate "go/no-go" decision should always rest with seasoned investors who can combine data insights with their personal conviction [3].

Standardizing processes is another key to success. AI can help by automating the creation of consistent evaluation frameworks, such as 15-point checklists or weighted risk matrices. This ensures every opportunity is assessed against the same objective criteria [4]. Tools like StratEngineAI can automate pitch deck reviews and generate traceable investment memos, cutting due diligence timelines from weeks to minutes. For example, an XGBoost model used for startup screening outperformed the median venture capitalist by 25%, underscoring the potential of data-driven approaches when implemented thoughtfully [6].

Conclusion

AI is transforming how venture capital firms handle due diligence. Tasks that once took weeks of manual effort are now completed in days - or even minutes - with improved accuracy and consistency. By 2025, it's estimated that more than 75% of VC executive reviews will integrate AI and data analytics into their processes [5].

But it’s not just about speed. AI brings a level of objectivity to a process often influenced by cognitive bias, scalability to assess hundreds of opportunities at once, and depth to identify risks buried in unstructured data. These could include signals from founder social media activity, patent filings, or regulatory updates [1][5]. As Artur Haponik from Addepto explains:

"AI-powered due diligence doesn't just save time; it makes the entire process more accurate and objective" [1].

The industry is also moving beyond using AI as a simple tool to adopting it as an autonomous system capable of managing entire workflows. These include tasks like intake, scoring, risk flagging, and even generating investment memos with audit-ready traceability [6]. Platforms such as StratEngineAI now automate pitch deck evaluations and produce detailed, traceable investment memos while ensuring institutional-quality standards.

However, even with these advancements, the human element remains indispensable. The most effective firms are those that combine AI's ability to process vast amounts of data with the nuanced judgment of experienced investors. AI can handle the heavy lifting, but decisions about team dynamics, founder resilience, and market potential still require human insight [1][6]. In a field where only 1 in 400 startups secures funding [6], this balance between technology and human expertise is becoming essential - not just a competitive advantage.

The future of venture capital lies in standardizing frameworks, adopting AI in phases, and using data to guide rather than replace conviction. This approach aligns with the structured risk frameworks discussed earlier. As Jared Heyman from Rebel Fund puts it:

"The future of venture capital lies in combining human judgment with technological capabilities" [4].

FAQs

How does AI enhance the accuracy of venture capital due diligence?

AI enhances the precision of venture capital due diligence by using machine learning and natural language processing to sift through massive datasets with speed and efficiency. It uncovers financial risks, market irregularities, and information gaps that might escape even the most diligent human reviewers.

By automating the review of unstructured data, AI delivers sharper and more detailed insights, allowing investors to make decisions more confidently and quickly. This approach minimizes bias and strengthens the thoroughness of the due diligence process, ensuring a well-rounded assessment of investment opportunities.

How does AI help identify team and operational risks during due diligence?

AI has become an essential tool for spotting team and operational risks early in the venture capital due diligence process. It works by analyzing a mix of structured data - like cap table composition, financial burn rate, and runway - and unstructured data, such as founder bios, pitch deck language, and even internal communications. From this, AI generates a risk-adjusted readiness score. This score pinpoints potential red flags, including misaligned incentives, exaggerated experience, or signs of operational strain, giving investors the chance to address these issues before drafting a term sheet.

Beyond the initial evaluation, AI also keeps an eye on ongoing risks. It flags sudden changes like unexpected headcount shifts, spikes in employee turnover, or departures from established processes - insights that might go unnoticed with traditional tools. Platforms such as StratEngineAI take this a step further by automating tasks like pitch deck analysis, assessing founder experience, mapping organizational structures, and creating detailed investment memos. These platforms use strategic frameworks like SWOT and Porter’s Five Forces to evaluate both team dynamics and operational risks. The result? Investors can make decisions that are not only faster but also more thorough and well-informed.

How does AI help standardize venture capital investment decisions?

AI-driven frameworks offer venture capital teams a systematic way to evaluate investments. By incorporating tools like SWOT analysis, Porter’s Five Forces, and Blue Ocean analysis, AI can handle tasks such as estimating market size, analyzing competitive landscapes, and identifying potential risks. This approach ensures that every investment opportunity is evaluated using consistent criteria, minimizing reliance on subjective opinions.

In addition, AI simplifies the due diligence process by using automated checklists to cover areas like financials, governance, ESG considerations, and vendor risks. These tools generate unified, risk-adjusted scorecards, making it easier to compare deals objectively. AI also transforms raw data - such as financial reports and product metrics - into concise, traceable investment memos. This reduces bias and creates a transparent record for decision-making.

By integrating these frameworks with strategic intelligence platforms, venture capital firms can speed up deal evaluations, make quicker decisions, and uphold the level of thoroughness and consistency expected by both leadership and investors.