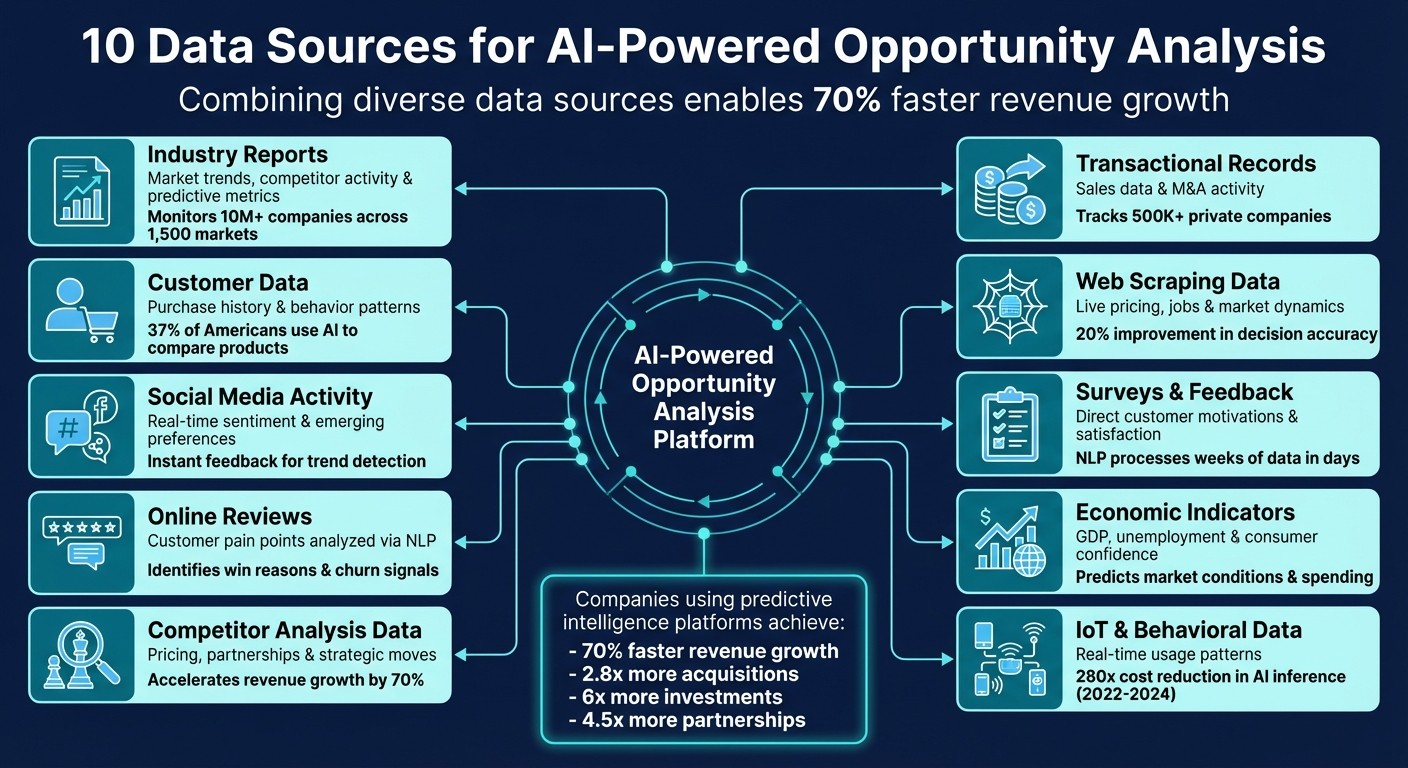

10 Data Sources for AI-Powered Opportunity Analysis

Combining industry reports, customer behavior, social signals, IoT, and web-scraped data lets AI detect opportunities early and speed smarter decisions.

Jan 16, 2026

AI-driven opportunity analysis thrives on diverse, high-quality data sources. By combining multiple types of data, businesses can make faster, more informed decisions, identify trends early, and reduce risks. Here’s a quick breakdown of the top data sources that power AI systems:

Industry Reports: Offer market trends, competitor activity, and predictive metrics.

Customer Data: Purchase history and behavior reveal unmet needs and future trends.

Social Media Activity: Tracks real-time sentiment and emerging preferences.

Online Reviews: Highlights customer pain points and product strengths using NLP.

Competitor Analysis Data: Maps partnerships, pricing, and strategic moves.

Transactional Records: Sales and M&A data predict growth opportunities.

Web Scraping Data: Captures live market dynamics like pricing and job postings.

Surveys and Feedback: Provides direct insights into customer motivations.

Economic Indicators: Tracks macro trends like GDP and consumer confidence.

IoT and Behavioral Data: Real-time usage data reveals product traction.

Key Takeaway: Combining these data sources allows AI platforms to deliver faster, smarter insights that help businesses stay ahead of the curve. By integrating trends, feedback, and financial signals, companies can act on opportunities before competitors even notice them.

10 Essential Data Sources for AI-Powered Opportunity Analysis

Real-World AI Data Analysis Use Cases

These examples demonstrate how AI-powered market research tools transform raw data into strategic advantages.

1. Industry Reports

Industry reports serve as the foundation for AI-powered opportunity analysis. They provide real-time insights into market changes, disruptive technologies, and emerging trends [6]. Instead of relying on quarterly earnings or breaking news, AI platforms analyze these reports to uncover patterns and predict where markets are headed. This wealth of information forms the basis for generating predictive metrics.

These reports are packed with detailed data. Some market intelligence tools monitor over 10 million companies across 1,500 unique markets, feeding data into predictive AI models [1]. Metrics like "Exit Probability" and "Commercial Maturity" scores highlight potential market leaders [1][2]. They also track unique data points like patent filings, job openings, and business relationship networks - often referred to as "Rare Data" by industry experts [2].

For competitive intelligence, these reports monitor real-time updates on competitor investments, partnerships, acquisitions, and product launches [6][5]. AI systems process this data across thousands of variables to create a comprehensive map of competitive landscapes. Nicole Harper, Director of Corporate Strategy at Jack Henry, explains:

"Strategy teams need more than just data. CB Insights makes data actionable so you know what to do next" [5].

This combination of qualitative and quantitative insights integrates seamlessly into broader AI frameworks, enhancing the accuracy of opportunity assessments and enabling faster strategic decisions.

The key advantage lies in speed and precision. AI can reduce the time needed to create strategic briefs in minutes, delivering consistent, actionable benchmarks. These benchmarks help compare company performance and generate executive-ready insights [6]. By replacing guesswork with reliable data, decision-makers gain the confidence to act decisively.

2. Customer Data

Customer data provides a window into real buying habits and unmet needs. Details like purchase history, browsing behavior, and transaction records create a rich picture of what customers want - often uncovering gaps businesses haven’t yet addressed. By analyzing these patterns, machine learning tools can predict future actions, such as which customers may stop buying or which groups are ready for premium services [7].

The shift from reactive to predictive analysis is a game changer. Traditional analytics focus on what happened in the past, but AI-powered systems take historical data and use it to forecast future trends - whether that’s next month’s sales, upcoming market shifts, or changes in customer preferences. For example, 37% of Americans now rely on AI to compare products before buying, adding even more behavioral data into these systems [9]. This constant feedback loop improves the accuracy of predictions, helping businesses form a more complete view of the market.

These predictive tools aren’t just theoretical - they deliver results. Adam Orris, Director of Data and Analytics at Function Growth, shared how they’ve transformed his team’s work:

"Improvado transformed our approach to marketing analytics. Its automation capabilities and AI-driven insights allowed us to focus on optimization and strategy, without the need for manual data management" [7].

AI also uncovers patterns within customer groups, pinpointing opportunities like cross-selling commonly paired products or identifying how sensitive different segments are to pricing. Marketing teams using these tools can save up to 30% of their time, shifting focus from manual data crunching to high-level strategy [7].

But data is most powerful when combined. Merging purchase history with customer feedback allows AI to identify emerging trends with pinpoint accuracy [3]. Companies leveraging this kind of predictive intelligence are seeing impressive results - growing revenue up to 70% faster than competitors [2].

3. Social Media Activity

Social media data plays a pivotal role in opportunity analysis by offering a real-time window into consumer sentiment. Every post, comment, like, and share contributes to a continuous flow of insights that help AI tools identify emerging trends before the market catches on. This instant feedback is just as valuable as traditional industry reports or customer data when it comes to shaping predictive analytics.

AI-powered sentiment analysis simplifies the overwhelming volume of social media activity into meaningful patterns. Instead of manually combing through countless comments, automated systems pinpoint key insights like buying preferences, satisfaction levels, and brand perceptions gathered from digital conversations [1]. When combined with traditional data sources, these insights provide a more complete and accurate foundation for opportunity analysis.

The real game-changer? Moving from reactive to predictive decision-making. Businesses no longer have to rely solely on quarterly reports to understand market sentiment. AI tools now offer real-time insights into competitor actions, potential partnerships, and other market dynamics, transforming social media signals into actionable intelligence that feeds into broader AI frameworks [2].

By analyzing consumer behavior and sentiment patterns, AI tools can validate strategies before companies make significant investments, helping to minimize the risk of costly missteps [11][1]. Companies leveraging these predictive intelligence platforms have reported revenue growth rates 70% faster than their competitors [1][2].

It’s important to recognize that social media metrics go far beyond vanity numbers. Metrics like engagement rates, the tone of comments, and sharing trends reveal which products are hitting the mark, which features are causing frustration, and where untapped opportunities lie - empowering businesses to make quicker, more confident decisions.

4. Online Reviews

Online reviews provide AI tools with a direct line to the unfiltered voice of the customer. Unlike structured surveys or carefully managed focus groups, these reviews capture raw emotions, highlight pain points, and reflect genuine satisfaction - all in the customer’s own words. Using natural language processing (NLP), AI can extract valuable insights like buying criteria, satisfaction levels, and even predict the likelihood of customer churn from review content [1].

AI also identifies Win Reasons - the specific factors that lead customers to pick one product over another - and highlights Key Product Features that either delight or frustrate users [4]. For instance, if hundreds of reviews repeatedly mention issues like a "clunky interface" or "slow customer support", AI quickly flags these recurring themes, transforming scattered feedback into actionable insights [13].

This process doesn’t stop at simply summarizing feedback. AI can take it a step further by diagnosing specific problems, such as identifying a software bug mentioned across multiple reviews, and even suggesting product updates or employee training to resolve recurring complaints [13]. Additionally, strategic planners can analyze competitor reviews side-by-side, uncovering gaps in their own offerings and pinpointing areas where customer satisfaction is thriving [5].

With the rise of predictive intelligence, AI can now anticipate customer behavior. For example, increasing mentions of words like "frustration" or "competitor" in reviews can signal a higher risk of churn [13]. By combining review data with other sources - such as web traffic, technographic data, and public disclosures - teams can craft stronger strategies, identify market opportunities ahead of the curve, and refine their investment decisions [3][14]. This seamless integration of review-based insights enhances AI’s ability to support smarter, more informed decision-making.

5. Competitor Analysis Data

Competitor data plays a critical role in helping AI identify the strengths, weaknesses, and untapped opportunities within the market. By analyzing factors like pricing strategies, product offerings, market positioning, partnerships, and even sentiment from earnings calls, AI uncovers insights that traditional methods might miss. This approach lays the groundwork for understanding complex business relationships.

Business relationship mapping is a key element here. It involves tracking competitor partnerships, licensing agreements, and client networks. This allows AI to predict strategic moves before they become public knowledge and highlight "network gaps" - areas where no competitor is currently meeting demand [4][5]. For instance, if a competitor partners with a cloud infrastructure provider, AI might flag this as a sign they’re targeting enterprise markets. That early signal gives you a chance to decide whether to compete or pivot.

Natural Language Processing (NLP) tools take this analysis further by scanning public disclosures and earnings calls to identify changes in pricing or positioning from one quarter to the next [4]. When this data is paired with job postings and patent filings, AI can even predict future product launches or shifts in R&D priorities, giving strategy teams a head start on upcoming developments.

This predictive intelligence turns raw competitor data into actionable strategies, potentially accelerating revenue growth by up to 70% [2][1]. Some AI platforms now provide tools like "Mosaic Scores", which are proprietary metrics that assess a competitor’s overall health, financial stability, and growth potential. These insights help strategy teams pinpoint which rivals are vulnerable or gaining ground [1]. Additionally, AI can produce instant scouting reports that detail a competitor's business model, market positioning, and areas for differentiation [4][1].

"Strategy teams need more than just data. CB Insights makes data actionable so you know what to do next." - Nicole Harper, Director of Corporate Strategy, Jack Henry [5]

6. Transactional Records

Transactional records - like sales data and M&A activity - play a key role in enhancing AI strategy and market trends and identify future leaders. These financial patterns shed light on which products are gaining traction, which markets are becoming hotspots, and which companies are poised for significant growth. AI platforms now monitor revenue signals for over 500,000 private companies, offering year-by-year estimates that help strategy teams identify high-growth opportunities early on [1].

By examining historical transaction data, AI builds predictive models that forecast commercial milestones and the likelihood of exits [4][5]. For example, a spike in M&A activity within a particular industry might alert teams to potential acquisition targets or indicate that competitors are shifting their strategies. This kind of analysis speeds up decision-making and provides a competitive edge.

Industry leaders have already seen the impact of these insights.

"CB Insights proprietary benchmarking data alone helped me prioritize a market, find an up-and-coming AI company, qualify and close a $120 million opportunity." – Big 3 Cloud Leader [2]

AI also identifies high-potential companies that traditional methods often overlook - about 30% of them, to be exact [2]. By combining public earnings data with private revenue signals, these models spot fast-growing companies that might not yet be widely recognized. Proprietary financial health metrics further refine predictions, turning raw transaction data into actionable insights [1].

On top of this, AI automates much of the work involved in commercial due diligence. From processing cap table histories to analyzing funding rounds and financial metrics, AI can instantly generate sales account plans or scouting reports [2][4]. This automation shifts due diligence from being a backward-looking process to one that focuses on future strategy.

7. Web Scraping Data

Web scraping plays a crucial role in gathering real-time data like prices, reviews, promotions, job postings, and news, organizing it into structured formats for AI analysis. Unlike traditional market research, which often relies on delayed reports, web scraping captures live market dynamics. This gives strategy teams an up-to-the-minute understanding of market conditions.

With 90% of global data created in just the past two years, manual monitoring has become impractical [15]. AI-driven scraping automates this process, allowing companies to work with current data instead of outdated snapshots. This approach can improve decision-making accuracy by 20% [15], ensuring strategies remain relevant and adapt quickly to changing conditions.

"AI tools continuously monitor competitors' strategies, pricing, and product launches, providing real-time alerts that track market shifts automatically." – Clyde Christian Anderson, Founder and CEO, GrowthFactor.ai [15]

Beyond tracking prices, web scraping offers insights into job market trends, unmet customer needs, and early signs of partnerships. For example, analyzing job postings can reveal a competitor’s plans for rapid expansion or market entry. Monitoring social media and customer reviews can highlight gaps in products or services, while news articles and press releases may unveil partnership announcements or acquisition activity before they’re widely reported [1]. Advanced platforms now track over 10 million companies worldwide using automated scraping [1], turning online activity into actionable strategic insights. When combined with other data sources, these findings provide a well-rounded, AI-driven view of opportunities.

Natural language processing (NLP) tools enhance the efficiency of analyzing scraped text [14]. The real strength lies in merging multiple data streams - such as web traffic, pricing trends, and social signals - to validate findings instead of relying on a single source [3]. While human oversight is still necessary to ensure data accuracy, AI significantly accelerates the analysis process compared to manual methods [15].

8. Surveys and Feedback

Surveys and customer feedback offer insights that raw numbers often fail to capture. While industry reports can highlight overarching trends and web scraping might track competitors’ moves, surveys dig into what really matters: the thoughts and motivations of your customers. They reveal details like satisfaction levels and renewal likelihood, painting a clearer picture of customer behavior [4][1]. This type of direct input helps businesses understand their audience on a deeper level, reducing the chances of misguided investments [11].

"Asking consumers yourself can give you a nuanced understanding of your specific target audience." – U.S. Small Business Administration [11]

Thanks to AI-powered tools, analyzing survey responses and customer interviews has become faster and more efficient. Natural Language Processing (NLP) can sift through unstructured feedback to identify sentiment, recurring themes, and key takeaways [1][8]. What used to take weeks can now be done in days, with automation spotting patterns that manual analysis might overlook [8].

Survey insights become even more powerful when combined with other data sources. For instance, qualitative feedback about product-market fit gains credibility when it aligns with measurable indicators like funding trends or team growth [3]. Surveys can also validate assumptions about key factors, such as how new customers are acquired or how purchasing processes can improve [11].

To get the most out of surveys, prioritize quality over quantity. A smaller set of well-thought-out responses often yields better results for AI analysis than a flood of low-quality data [12]. Use surveys to explore market saturation by asking potential customers about the alternatives they use and their associated costs [11]. Dive into interview transcripts to identify unmet needs by spotting repeated complaints or missing features customers mention in relation to competitors [4]. When paired with transactional data, social media sentiment, and broader economic indicators, survey insights provide the context needed to make AI-driven analyses actionable. This blend of qualitative and quantitative data creates a fuller view of opportunities and challenges.

9. Economic Indicators

Macroeconomic data lays the groundwork for understanding whether market conditions will support or challenge a business opportunity. AI platforms analyze key metrics like GDP growth, unemployment rates, and consumer confidence to anticipate market trends [13, 25]. These indicators help address critical questions: Is the market growing or shrinking? Are consumers financially capable of purchasing products? Are businesses expanding their workforce or scaling back? This broad perspective allows AI models to fine-tune insights with more detailed, micro-level data.

For instance, employment stability is a reliable indicator of consumer spending power when paired with predictive signals from customer and transactional data. Jharonne Martis, Director of Consumer Research at LSEG, explained:

"Shoppers remain engaged largely because of stable employment, though job security remains the biggest risk to future spending" [16].

AI platforms also monitor job openings relative to company size to identify rapidly growing businesses, while unemployment trends highlight regional market vulnerabilities [1, 13]. When the U.S. Consumer Price Index (CPI) recorded a 2.7% annual increase in November 2025, AI systems adjusted pricing strategies and flagged a shift toward discount-oriented purchasing behaviors [16].

Shifts in consumer sentiment often foreshadow changes in sales patterns. For example, in early 2026, the LSEG/Ipsos Primary Consumer Sentiment Index revealed a significant drop in "purchasing comfort." This prompted AI systems to update forecasts, reflecting a slowdown in online sales growth to 5.1% year-over-year in Q3 2025, compared to 7.6% the previous year. Simultaneously, discretionary spending shifted toward travel and experiences rather than physical goods. As a result, the Hotels, Restaurants & Leisure sector is now expected to achieve 10.9% earnings growth in 2026, mirroring this change in consumer behavior [16].

In January 2026, LSEG analysts leveraged AI-weighted earnings estimates to predict a positive earnings surprise for Dillard's, with the AI model forecasting an EPS of $11.03, surpassing the consensus estimate of $10.61 [16].

10. IoT and Behavioral Data

IoT data has taken opportunity analysis to the next level by adding real-time behavioral insights to the mix. Connected devices and tracking systems provide continuous streams of data that show how consumers actually use products. This means companies can uncover usage patterns that traditional surveys often miss. AI platforms then process this rich digital data to detect product traction and market reach - even before official numbers are released [3].

The impact of predictive intelligence is hard to ignore. Companies that use real-time behavioral data to anticipate market trends can grow their revenue 70% faster than competitors [2]. A great example is Waymo, which provided 150,000 autonomous rides weekly in 2023, showcasing how IoT data can fuel innovation in transportation [10]. Similarly, the FDA approved 223 AI-enabled devices in 2023, a leap from just six in 2015. Many of these devices rely on IoT data from wearables and monitoring tools [10].

The cost of analyzing IoT data has also plummeted. Between November 2022 and October 2024, the inference costs for GPT-3.5-level AI systems dropped by an astounding 280-fold, making it easier and more affordable to process massive IoT datasets in real time [10]. Manufacturers now use sensor data to monitor operations as they happen [12], while retailers analyze satellite imagery of parking lots to estimate foot traffic and predict sales [14].

"The rising importance of alternative data streams - such as app usage metrics, web traffic, and open-source developer activity - provides tempo signals that often precede formal financing rounds." – Guru Startups [3]

Modern AI platforms blend data from various sources like app downloads, GitHub activity, and web traffic to confirm product-market fit and gauge market momentum [3]. However, this comes with privacy challenges. Organizations are adopting real-time masking of personally identifiable information (PII) and using federated data architectures to comply with regulations while extracting useful insights [3][12]. To ensure accuracy in fast-moving markets, they also rely on timestamp alignment, cross-source reconciliation, and standardized taxonomies to integrate data from diverse IoT sources seamlessly [3].

Combining Data Sources in AI Platforms

Modern AI platforms excel at bringing together multiple data streams to create a unified, easy-to-understand view. This capability builds on the idea of data triangulation, where different sources are cross-referenced to uncover patterns that might otherwise remain hidden. Instead of manually piecing together data, these platforms automatically align and analyze the inputs, reducing errors and strengthening investment strategies by confirming insights across various channels [3].

When AI takes over the heavy lifting, strategic planning becomes lightning-fast. Tasks like ranking potential target companies or producing detailed scouting reports, which once took hours, now happen in seconds. For example, StratEngineAI uses over 20 frameworks - such as customized SWOT analysis and Porter's Five Forces - to craft strategic briefs and investment memos in just minutes, all while maintaining high analytical standards [1].

The results for businesses are striking. Companies using predictive intelligence platforms have reported 70% faster revenue growth compared to peers [2]. AI-driven strategy teams achieve 2.8 times more acquisitions, six times more investments, and 4.5 times more partnerships [2].

"In a matter of minutes, we created a target list and screened 6 M&A targets for a big meeting. Our client acquired one of them 3 months later" [2].

By integrating diverse data sources, visual intelligence tools transform massive amounts of information into clear, actionable insights. Tools like strategy maps and relationship graphs highlight market shifts and trends that would otherwise remain buried in spreadsheets and reports [2].

"We review twice as many companies now with the confidence that we have a full view of the market" [2].

Proprietary scoring systems further enhance these insights by combining factors like performance metrics, financial stability, market conditions, and management strength. This approach identifies roughly 30% more high-potential companies that traditional methods often overlook [2].

The move from reactive to predictive intelligence marks a major shift in how organizations discover opportunities. Instead of waiting for trends to become obvious, AI platforms detect early signals - well before the broader market catches on.

"Real-time visibility into every emerging tech market." [2]

This ability to act quickly on emerging opportunities gives strategy teams a clear edge, allowing them to make decisions when the potential for success is at its peak. By synthesizing data proactively, AI platforms enable smarter, faster decisions that drive strategic advantage.

Conclusion

Making smart strategic decisions hinges on having data that’s timely, diverse, and deeply relevant [3]. Relying on just one data source can lead to costly mistakes in understanding valuations, market trends, or competitive landscapes. But when you combine multiple data streams - like hiring trends, patent activity, web traffic, and even social sentiment - you get a much clearer and more reliable view of the bigger picture, one that internal data alone simply can’t provide.

This solid data groundwork allows AI platforms to completely transform traditional workflows. Tasks that used to take hours can now be done in seconds. And it’s not just about saving time - this kind of efficiency delivers real business results. Companies using predictive intelligence platforms experience 70% faster revenue growth, make nearly three times as many acquisitions, and secure six times more investments [2].

Switching from a reactive to a predictive approach gives strategy teams a critical edge. Instead of waiting for obvious market shifts, AI identifies early indicators - like developer activity or app usage - that hint at future financial trends. Acting on these early signals means organizations can seize opportunities at their peak value, paving the way for bold, forward-thinking strategies.

The path ahead is clear: build a strong data sourcing strategy, use aggregation tools to tap into multiple data sources with ease, and let AI handle the heavy lifting of routine analysis. By bringing together diverse data points - from social sentiment to transactional insights - platforms like StratEngineAI turn overwhelming amounts of information into actionable, real-time strategies.

FAQs

How can businesses combine multiple data sources for AI-driven opportunity analysis?

To bring together various data sources for AI-powered opportunity analysis, start by structuring your internal datasets. This could include information like sales figures, CRM entries, or product usage metrics. Once these are in order, add external sources such as industry reports, market trends, regulatory filings, and competitor data. A centralized data platform or warehouse can simplify this process by standardizing data formats, ensuring quality, and making the information ready for AI models.

Automating the data collection process with API-driven feeds and AI tools can save a lot of time and effort. Tools like StratEngineAI make this easier by merging internal and external datasets, applying strategic frameworks like SWOT analysis or Porter's Five Forces, and generating insights you can act on. This approach reduces the need for manual data handling and speeds up decision-making.

To ensure the insights generated by AI are trustworthy, cross-check them with multiple sources. Regular updates to your data and resolving any inconsistencies will further enhance the accuracy of your analysis, helping your business confidently uncover market opportunities.

How does social media data help in identifying market trends?

Social media platforms such as Twitter, LinkedIn, Instagram, and Reddit churn out massive amounts of unstructured data every single day - think posts, comments, and reactions. This treasure trove offers real-time insights into what consumers are feeling, what they’re gravitating toward, and the conversations dominating online spaces. By leveraging AI technologies like natural language processing and machine learning, businesses can sift through this data to uncover sentiment shifts, recurring themes, and viral topics - often pinpointing market changes before they’re widely recognized.

The immediacy and granular nature of social media data make it an incredibly effective tool for spotting trends ahead of traditional reporting methods. AI can analyze sentiment, map out influencer networks, and monitor keyword activity spikes, transforming raw interactions into meaningful insights. Platforms like StratEngineAI take it a step further by combining social media data with other sources to provide strategic recommendations, enabling consultants and investors to seize opportunities with speed and precision.

How does AI turn transaction data into practical insights?

AI takes raw transaction data and refines it through cleaning and standardization. Once prepped, it uses machine learning algorithms to uncover patterns, trends, and anomalies. This deep analysis sheds light on areas like customer behavior, sales performance, and inefficiencies in operations.

The findings are then converted into clear metrics, forecasts, and practical recommendations, making it easier for businesses to act swiftly and with confidence. By automating this entire process, AI not only saves valuable time but also highlights opportunities that might have been overlooked, helping businesses refine their strategies effectively.