AI-Powered Scenario Planning for Risks

AI speeds scenario planning, models interconnected financial, operational, regulatory and ESG risks, and turns data into actionable strategies while requiring clean data and human oversight.

Dec 17, 2025

AI-powered scenario planning is transforming how businesses manage risks. By using advanced analytics and real-time data, AI helps organizations quickly identify potential threats, create multiple future scenarios, and develop actionable strategies. Unlike manual methods, AI processes vast datasets, uncovers patterns, and models complex interactions between risks, enabling faster, more informed decisions.

Key Points:

AI Benefits: Speeds up risk analysis, improves accuracy, and identifies interconnected risks.

Common Risks Addressed: Financial instability, supply chain issues, regulatory changes, and ESG challenges.

AI Techniques Used: Predictive modeling, Monte Carlo simulations, and natural language processing.

Challenges: Requires clean data, human oversight, and addressing model biases.

Practical Applications: Platforms like StratEngineAI simplify scenario planning by automating research and generating actionable insights.

AI doesn't replace human expertise but enhances decision-making by handling complex data efficiently. Companies leveraging AI for risk management gain a competitive edge in navigating uncertainty.

The Role of AI in Scenario Planning and Risk Forecasting

Scenario Planning Basics for Risk Management

Scenario planning takes a broader approach to understanding the future by considering multiple possibilities rather than relying on a single prediction. It recognizes that uncertainty is inevitable and prepares businesses to handle a variety of outcomes. Instead of asking, "What will happen?" it shifts the focus to, "What could happen, and how would we respond?" This change in mindset turns risk management into a proactive effort. With the integration of AI, this process becomes even more refined, enhancing analysis and improving the development of scenarios. This proactive groundwork sets the stage for more advanced risk management strategies, which are explored further in later sections.

The process starts by identifying key uncertainties and drivers - factors that could significantly influence the business environment. These might include regulatory changes, technological advancements, shifts in consumer preferences, or broader economic trends. Once these drivers are outlined, teams develop scenarios that explore how these elements might evolve and what their strategic or operational impacts could be. Each scenario paints a different picture of the future, helping teams anticipate challenges and align their strategies accordingly. This collaborative effort ensures that organizations are better prepared to tackle emerging risks.

Common Risk Types in Scenario Planning

Organizations encounter risks across various domains, each demanding a tailored analytical approach.

Financial risks: These include market volatility, currency fluctuations, credit defaults, and liquidity challenges. While historical data can help model these risks, unexpected events can still take companies by surprise.

Operational risks: These cover supply chain disruptions, technology breakdowns, cybersecurity threats, and workforce issues. The pandemic highlighted how fragile global supply chains can be - something as small as a port closure or a semiconductor shortage can have far-reaching effects across industries.

Regulatory risks: Changing compliance requirements, new laws, and shifting enforcement priorities present challenges, especially for businesses operating in multiple regions with varying standards.

ESG and climate risks: These have moved to the forefront of strategic planning. Physical climate impacts, the transition to decarbonization, and rising stakeholder expectations are reshaping industries and forcing companies to reevaluate their priorities.

Understanding these risks is essential for selecting the right analytical frameworks to address them.

Scenario Planning Frameworks and Methods

Several well-established frameworks provide structure for scenario planning efforts:

PESTLE analysis: This framework examines six key factors - Political, Economic, Social, Technological, Legal, and Environmental - to identify external risks and opportunities in the broader environment.

SWOT analysis: By mapping internal strengths and weaknesses against external opportunities and threats, this approach helps organizations pinpoint vulnerabilities and areas to build resilience.

Porter’s Five Forces: Focused on competitive dynamics, this model evaluates factors like supplier power, buyer power, competitive rivalry, the threat of substitutes, and barriers to entry, offering insights into potential industry shifts.

Blue Ocean Strategy: For those looking to break away from traditional competition, this framework identifies untapped market spaces where new value propositions could mitigate risk.

Uncertainty mapping: This method plots key drivers based on their impact and uncertainty, helping teams prioritize the most critical factors. From there, narratives are constructed around these drivers, creating detailed stories about potential futures. Stress testing is then used to measure the impact of these scenarios.

While AI tools can speed up the process of organizing these frameworks, human judgment remains crucial in deciding which scenarios deserve the most attention and strategic preparation.

How AI Changes Scenario Planning

AI is transforming scenario planning by handling massive amounts of data that would be impossible for humans to process manually. Instead of relying solely on past trends and expert opinions, AI tools can sift through complex datasets, uncover hidden patterns, and propose scenarios that might never occur to human planners. The role of human expertise doesn’t disappear here - it shifts. Strategists can now spend less time compiling data and more time interpreting it and making decisions. This shift not only speeds up the process but also allows for more detailed and layered scenario building.

The biggest changes are in speed and scale. Tasks that once took weeks of manual effort can now be completed in mere hours. This acceleration gives organizations a leg up in responding to risks before they spiral out of control. In fast-changing markets, being able to act quickly and with better information can make all the difference.

AI also brings a new level of depth to scenario analysis. Traditional methods often look at risks in isolation, but AI can reveal how various factors interact and compound each other. For instance, it might show how supply chain issues, currency shifts, and regulatory updates could combine to create a worst-case scenario - something that wouldn’t be obvious when analyzing each factor alone. By uncovering these connections, AI helps teams prepare for challenges that are multi-dimensional and far more complex than they might initially appear [1].

AI Techniques for Scenario Planning

Several AI methods are particularly helpful for planning around risks:

Predictive modeling uses machine learning to find patterns in historical data and predict how similar conditions might play out in the future. These models can juggle thousands of variables at once, spotting connections that human analysts might miss.

Monte Carlo simulations run countless iterations to explore how different variables might interact under various conditions. This method is especially useful for financial risk analysis, where even small changes in interest rates or credit defaults can have widespread effects. The simulations don’t just show what could happen - they also reveal how likely each outcome is.

Natural language processing (NLP) analyzes unstructured data, such as news articles, social media, and industry reports, to identify emerging trends and shifts in sentiment. This is particularly valuable for spotting early signs of regulatory changes or shifts in expectations around ESG (Environmental, Social, and Governance) issues. Large Language Models (LLMs) take it a step further by synthesizing information from multiple sources into strategic briefs that offer a well-rounded view.

AI tools also have the unique ability to challenge assumptions that teams might not even realize they’re making. By testing these assumptions against data, organizations can uncover blind spots in their risk assessments and create more comprehensive scenarios. These advanced techniques are opening new doors for tackling risks in smarter, more effective ways.

Benefits of AI-Powered Scenario Planning

AI slashes the time it takes to plan, turning what used to be a week-long process into something that can be done in a single afternoon [1]. This time-saving means teams can focus on higher-priority tasks like engaging stakeholders or planning how to implement strategies.

Another key advantage is accuracy. AI can process an enormous number of data points and detect patterns that signal emerging risks. Real-time monitoring means organizations no longer have to wait for quarterly reviews to spot potential issues - they can catch them as they happen. This allows for quicker adjustments and more effective responses.

AI also excels at analyzing interconnected risks. It can model how different factors influence each other, helping teams create scenarios that mirror the complexities of their actual environment. This results in better contingency plans and smarter strategic decisions.

Perhaps most exciting is how AI levels the playing field. Smaller companies, which might not have the resources for large strategy teams or expensive consultants, can now access high-quality scenario planning. This means more businesses can prepare for uncertainty with the same rigor as their larger competitors.

Challenges of AI-Driven Planning

Despite its many benefits, AI-driven scenario planning isn’t without challenges. The most fundamental issue is data quality - AI is only as good as the data it’s trained on. If the data is incomplete, outdated, or biased, the resulting scenarios will be unreliable. Clean, accurate data is non-negotiable for effective risk forecasting [1].

Bias in AI models is another concern. If historical data reflects past inequalities or systemic issues, those biases can carry over into predictions. For example, training data that overrepresents certain risks while ignoring others can skew results. Organizations need rigorous validation processes to catch and correct these biases before they impact decisions.

Then there’s the problem of explainability. Many AI models, especially deep learning systems, operate as "black boxes", making it hard even for their creators to explain how they arrived at specific conclusions. This lack of transparency can be a big issue in risk management, where executives need to understand - and justify - the reasoning behind decisions.

Finally, the human element remains crucial. Teams need proper training to use AI tools effectively, and they must oversee the outputs to ensure they make sense in the real world [1]. While AI can generate scenarios, it’s up to humans to evaluate their practicality and relevance. This underscores the idea that AI doesn’t replace human expertise - it enhances it, making strategic decision-making more informed and impactful.

Step-by-Step Guide to AI-Powered Scenario Planning

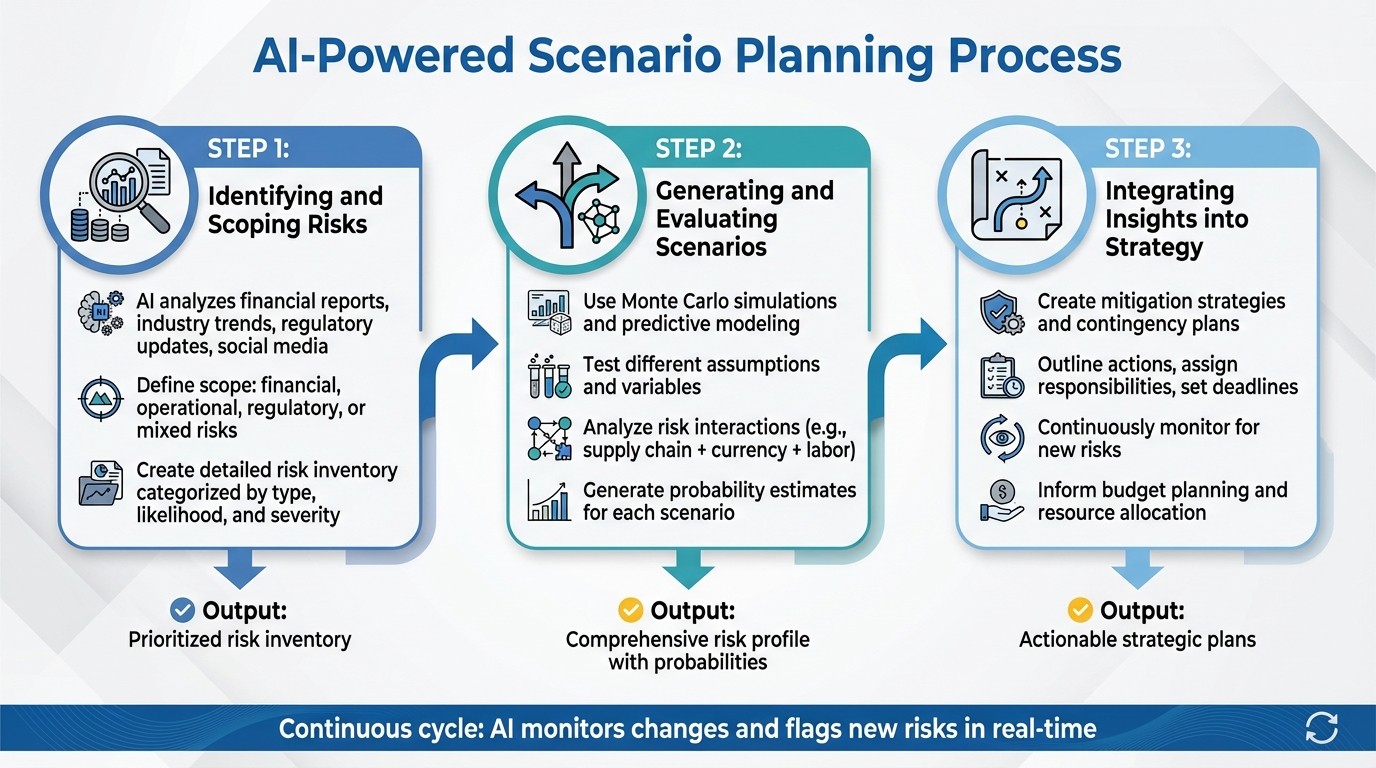

AI-Powered Scenario Planning: 3-Step Risk Management Process

Take your risk management to the next level by combining AI's data-crunching capabilities with human expertise in strategy. This process starts with identifying potential risks, moves into creating scenarios, and ends with embedding those insights into your strategic plans. Each phase builds on the previous one, creating a dynamic cycle of risk assessment and strategy adjustment. Organizations that adopt this approach as a continuous process can stay ahead of evolving challenges. Let’s break it down, starting with defining the scope of your analysis.

Identifying and Scoping Risks

The first step is pinpointing the risks that matter most to your organization. AI-powered tools can analyze vast amounts of data - like financial reports, industry trends, regulatory updates, and even social media chatter - to detect patterns signaling potential threats [1]. By automating the analysis, these tools save you from sifting through mountains of documents and help prioritize the risks with the highest potential impact.

Start by clarifying the scope of your analysis. Are you focusing on financial risks, operational challenges, regulatory shifts, or a mix of these? AI tools can adapt to your organization’s unique needs, offering customized frameworks rather than forcing you into a one-size-fits-all approach. The goal here is to create a detailed inventory of risks, categorized by type, likelihood, and severity. Platforms like StratEngineAI exemplify this by using AI to tailor risk frameworks specifically to your business environment, ensuring a more precise understanding of potential threats.

Generating and Evaluating Scenarios with AI

Once risks are identified, the next step is to explore potential outcomes. This is where AI really shines. Using methods like Monte Carlo simulations and predictive modeling, AI can analyze how various risks might play out and interact with one another.

In this phase, you feed your risk inventory into AI models, which then test different assumptions and variables. For instance, if supply chain disruptions are a concern, AI can simulate how a port closure might ripple through your operations, factoring in variables like currency shifts and labor shortages. Each scenario comes with probability estimates, helping you focus on the most likely outcomes. By repeatedly testing and refining these scenarios, you can uncover hidden dependencies and develop a comprehensive risk profile.

Integrating Insights into Business Strategy

The scenarios generated earlier are only useful if they lead to actionable strategies. This final step involves turning AI-driven insights into practical plans - whether that means creating mitigation strategies, setting up contingency plans, or making proactive adjustments to prepare for emerging risks.

AI can simplify this process by guiding you through established strategic frameworks. For example, if one scenario highlights a vulnerability to regulatory changes, AI tools can help outline a mitigation plan by identifying necessary actions, assigning responsibilities, and setting deadlines. These insights directly inform key decisions, from budget planning to resource allocation. Additionally, AI continuously monitors for changes, flagging new risks as they arise, so your strategies remain up-to-date. This ensures that risk management becomes an integral part of every decision, from launching new products to expanding into new markets.

AI-Powered Scenario Planning Across Risk Domains

AI-driven planning customizes risk assessments across various domains, offering targeted insights for financial, operational, regulatory, and ESG challenges. Building on earlier general methodologies, these specific examples highlight how AI plays a practical role in managing risks.

Financial Risk Management

Financial risks - like revenue fluctuations, cash flow issues, and funding uncertainties - can destabilize businesses. AI tools analyze historical data, market trends, and economic indicators to create multi-scenario financial projections. These projections provide real-time insights, enabling quick, informed financial decisions [1]. With continuously updated scenarios, businesses can test assumptions about interest rate shifts or currency changes, ensuring timely risk management.

Operational and Supply Chain Risks

Operational hiccups and supply chain weaknesses can spread through an organization rapidly. AI helps identify hidden interconnections and vulnerabilities within operations [1]. For instance, it can map relationships among suppliers, allowing companies to foresee potential disruptions and adjust plans before issues escalate.

Regulatory and ESG/Climate Risks

Shifting regulations and ESG reporting standards require businesses to stay agile in their risk management strategies. AI organizes risk assessments using frameworks like PESTLE, aligning strategies with changing regulations and ESG goals [1]. By questioning assumptions and generating in-depth research, AI helps organizations adapt to new compliance demands effectively.

Governance and Best Practices for AI-Powered Scenario Planning

Using AI for scenario planning demands clear governance to ensure both reliability and accountability. Without proper oversight, even the most advanced AI models can produce flawed or misleading forecasts. Defining ownership of these processes and establishing validation protocols can make the difference between gaining a strategic edge and making costly errors.

Governance Frameworks for AI-Driven Planning

Strong governance begins with leadership. Board-level oversight plays a critical role in guiding responsible AI use for risk management. Risk committees and senior executives should clearly define roles for reviewing AI-generated scenarios, examining model assumptions, and approving strategic decisions. It’s important to set approval thresholds - deciding which scenarios require executive input and which can be handled by operational teams.

Human involvement is essential for dependable risk forecasting [1]. AI may speed up scenario generation, but experienced strategists are still needed to validate outputs, question assumptions, and ensure recommendations align with the organization’s goals. Assigning dedicated individuals or teams to review AI-generated scenarios before they influence major decisions helps establish accountability and reduces the risk of over-reliance on automation.

In addition to human oversight, robust security and compliance measures are necessary for trustworthy AI deployment. For example, in November 2025, StratEngineAI showcased its commitment to security by embedding protections at the architectural level, adhering to standards like SOC 2 Type II, ISO 27001, CASA Tier 2, and AES-256 encryption [1]. Their default policy of zero data retention ensures that sensitive strategic information is not stored beyond its immediate use. Organizations adopting AI for scenario planning should prioritize similar safeguards, such as enterprise-grade encryption, continuous compliance monitoring, and rigorous security protocols. These measures align AI-driven insights with broader risk management strategies across the organization.

While governance structures are crucial, maintaining the integrity of AI models through strong data and assumption management is equally important.

Best Practices for Model Management and Validation

Producing reliable risk forecasts hinges on high-quality data and clear assumptions. AI-powered scenario planning relies on clean, well-organized data and robust model training to generate dependable insights. Establishing strict data governance practices to verify the accuracy and consistency of inputs is essential. Without this foundation, AI models cannot deliver trustworthy results.

Transparency in assumptions is also key. Tools that reveal the factors driving AI predictions allow strategists to question and refine the outputs. Regular validation cycles, where cross-functional teams examine model assumptions and test their sensitivity to critical variables, can identify potential issues like model drift before they affect decision-making.

Encouraging internal debate further strengthens scenario quality. By involving diverse stakeholders in critical discussions of AI-generated strategies, organizations can uncover blind spots, explore alternative perspectives, and refine their outputs. This collaborative approach boosts confidence in the insights provided by AI and ensures they are grounded in sound judgment.

The Future of Risk Management with AI

AI is revolutionizing risk management by making scenario planning faster and more insightful. What used to take days can now be completed in just hours, giving executives the ability to respond to potential threats with greater agility. But it’s not just about speed - AI also uncovers strategic patterns and delivers data-driven insights that might otherwise go unnoticed. These advancements are reshaping how leaders approach long-term planning.

Take platforms like StratEngineAI as an example. They streamline the entire strategic planning process, from initial research to the final presentation. By automatically generating detailed strategic briefs - complete with market analysis and competitive intelligence - tools like these turn complex risk scenarios into clear, actionable plans. Features such as the C-Suite Agent strategy debate and Assumption Exposer encourage teams to critically evaluate different scenarios, fostering deeper discussions.

Of course, effective risk forecasting still relies on clean data, proper training, and human oversight. As John S., COO, put it:

Our leadership meetings finally feel productive - we spend time deciding, not formatting.

This shift from tedious manual tasks to meaningful strategic discussions highlights the real value AI brings to risk management. By focusing on decision-making rather than administrative work, organizations can better leverage their leadership teams.

Looking ahead, companies that adopt AI-powered scenario planning will gain a distinct edge in today’s unpredictable business landscape. The technology enables quicker, more informed strategies without compromising the depth and quality that executives require.

FAQs

How does AI enhance the accuracy of scenario planning compared to traditional approaches?

AI brings a new level of efficiency to scenario planning by analyzing huge datasets at lightning speed and uncovering patterns that might be missed with traditional methods. It delivers insights rooted in data and adjusts to real-time updates, helping businesses predict risks with sharper accuracy.

What sets AI apart from manual methods is its ability to continuously update models as new information comes in. This ongoing refinement ensures strategies stay up-to-date and actionable, leading to smarter decisions and better ways to address potential risks.

What challenges do businesses encounter when adopting AI-powered scenario planning?

Businesses face several hurdles when trying to implement AI-driven scenario planning. One major obstacle is ensuring data quality and integration. AI models depend on accurate, well-rounded data to deliver meaningful insights. If the data is incomplete or unreliable, predictions can be off the mark, leading to weak strategies.

Another challenge lies in maintaining transparency and interpretability of AI models. Decision-makers often hesitate to rely on AI-generated recommendations if they can't clearly understand how those conclusions were reached. This lack of clarity can undermine trust and reduce the likelihood of acting on AI insights.

There's also the issue of resistance to change. Introducing AI tools frequently involves altering existing workflows, providing employee training, and fostering an environment that's open to new technologies - steps that can meet with pushback from teams or leadership.

Finally, tackling ethical concerns and bias in AI is a critical task. Models must be carefully designed to avoid unintended biases and to operate within ethical guidelines. This not only ensures fairness but also helps build trust in the system's outcomes.

How can businesses reduce bias in data used for AI-driven scenario planning?

To reduce bias in AI-driven scenario planning, businesses should prioritize gathering data from a wide range of diverse and representative sources. Performing regular bias audits and using fairness-focused algorithms can help pinpoint and address any underlying issues. Moreover, including team members from varied backgrounds in data review processes brings in a broader range of perspectives, enhancing the neutrality and dependability of the insights produced.