How AI Powers Real-Time Validation Monitoring

Real-time AI validation turns data quality from a periodic check into a continuous competitive advantage by catching errors at the source.

Feb 11, 2026

AI-powered real-time validation is transforming how companies ensure data accuracy and make informed decisions with automated strategic briefs. Traditional manual methods often miss critical errors due to delays and limited scope, but AI systems address these issues by continuously monitoring data streams, detecting anomalies, and maintaining data integrity. Here's why this matters:

Error Prevention at the Source: AI catches issues immediately as data flows through pipelines, avoiding contamination of reports and dashboards.

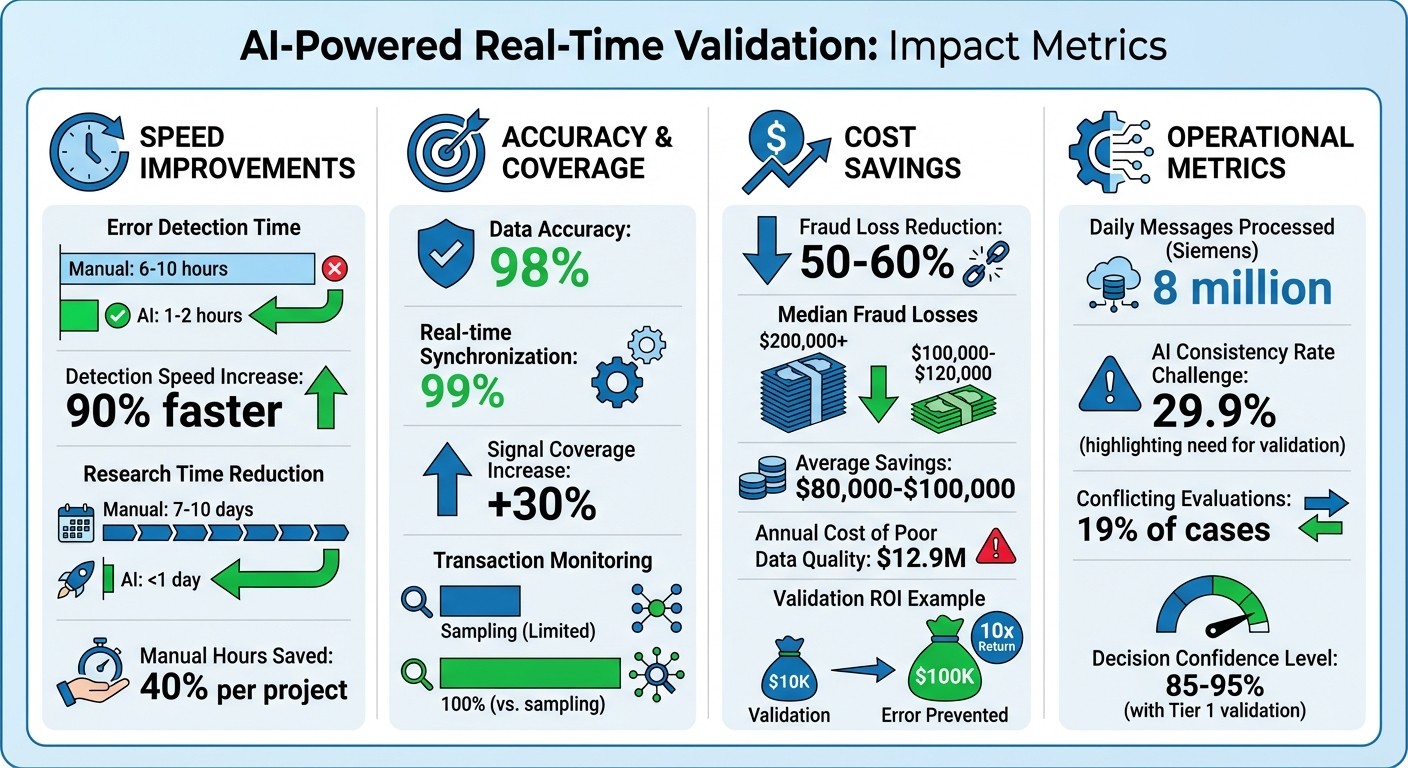

Faster Error Detection: AI reduces detection times from 6–10 hours to 1–2 hours and improves accuracy by 90%.

Cost Savings: Companies using AI validation report a 50–60% drop in fraud losses, saving $80,000–$100,000 on average.

Enhanced Decision-Making: With real-time insights, executives can act quickly on verified data, reducing risks in high-stakes scenarios.

Anomaly Detection: AI identifies subtle data shifts and silent drifts that manual checks often miss.

Automated Integrity Checks: AI reconciles and validates data across sources, ensuring reliability for critical decisions.

This shift from periodic reviews to continuous monitoring is revolutionizing data management, reducing costs, and enabling faster, more informed decision-making processes.

AI-Powered Real-Time Validation: Key Performance Metrics and Cost Savings

How AI Enables Real-Time Validation Monitoring

Automated Continuous Monitoring

AI has transformed the way data is monitored by replacing traditional batch checks with streaming validation, where data is inspected as it flows through pipelines. Instead of waiting for scheduled reviews, errors are caught at the source, stopping them from contaminating dashboards and reports [4]. This proactive approach, often called a "shift left" strategy, ensures problems are addressed before they escalate.

One key feature of this process is schema enforcement, which acts as a gatekeeper for incoming data. Tools like Schema Registry automatically reject or quarantine data that’s misformatted or missing required fields [4][1]. Any problematic data is sent to "dead-letter queues" for further review, protecting the integrity of production systems [4][1].

The impact is striking. AI-powered validation has cut the time needed for error detection and data source validation from 6–10 hours to just 1–2 hours [7]. Companies using these systems report a 90% faster error detection rate compared to manual methods [7].

A real-world example of this is Siemens Healthineers. In 2025, under the leadership of Scott Elfering, Head of Data Ingestion, the company implemented Confluent’s real-time streaming platform. This system processes 8 million messages daily and enables instant detection of manufacturing defects. It also allows for remote monitoring of equipment to ensure reliable diagnostic results, linking their entire technology lifecycle from manufacturing to hospital use [4].

Beyond continuous monitoring, AI also excels at detecting anomalies in real time.

Detecting Anomalies and Reducing Risk

AI leverages unsupervised anomaly detection to establish a baseline of what "normal" data looks like, flagging deviations such as volume drops, structural changes, or unexpected shifts in patterns [6]. This capability is particularly effective at identifying "silent data drift", a subtle degradation in data quality that static alerts often miss [6].

Adding another layer of security, real-time business rule logic is applied through tools like Apache Flink or ksqlDB. These frameworks analyze data in motion, catching out-of-range values or unusual spikes that basic schema checks might overlook [4]. AI agents compare live telemetry against historical trends and predefined business rules, identifying anomalies before they can disrupt critical dashboards [7].

The benefits are tangible. Organizations using AI-powered monitoring report a 50–60% reduction in median fraud losses, with losses dropping from over $200,000 to around $100,000–$120,000 [3]. Additionally, teams achieve 98% data accuracy and a 99% real-time synchronization rate, ensuring that decision-makers always work with reliable data [7].

These advancements not only reduce risks but also improve the efficiency of strategic decision-making by providing executives with validated data in real time.

Maintaining Data Integrity with AI

While detecting anomalies is crucial, ensuring overall data integrity is just as important. AI achieves this through automated reconciliation, which systematically matches records across different sources to ensure accuracy [1]. It also employs automated data triangulation, verifying data against multiple trusted sources to confirm quantitative claims [2]. This process is especially critical for AI models used in high-stakes decision-making, where robust validation is non-negotiable [2].

AI tools also create a continuous, timestamped audit trail, automating the collection of evidence for audits [3][1]. Unlike traditional quarterly or annual audits, this system monitors 100% of transactions in real time, providing unparalleled visibility into risks [3]. The result is a level of oversight that manual methods simply cannot achieve, ensuring data integrity at all times.

Benefits of AI for Real-Time Validation

Faster Decision-Making with Real-Time Insights

AI-powered validation removes the delays that often slow traditional planning cycles. Instead of waiting for periodic reviews to uncover issues days or weeks later, AI provides instant alerts when data deviates from expected patterns. This immediacy gives businesses a competitive edge - leaders can act on verified insights while opportunities are still viable.

Take the example from August 2025, when a global consulting firm adopted an AI-powered market research tools developed by an AI research team. This system cut research time from 7–10 days to less than a day and reduced manual analyst hours by 40% per project. Even more impressive, it increased signal coverage by 30%, identifying risks that manual processes had missed [5]. In high-stakes environments like fundraising or M&A, this speed is critical. Ouiam Akchar of Descartes & Mauss summed it up perfectly:

The cost of inaction. Especially in fundraising or M&A, delays can be fatal... In high-stakes environments, slow decisions are not neutral - they are negative.

This ability to deliver insights quickly also enhances accuracy, ensuring decisions are based on thoroughly validated data.

Higher Accuracy and Fewer Errors

Manual validation methods often rely on sampling, which can miss anomalies lurking in unchecked data. AI, on the other hand, examines 100% of transactions and data points in real time. This capability allows it to detect subtle issues, like silent data drift, that static rules might overlook [3][6]. By learning what "normal" looks like through pattern recognition, AI identifies deviations that traditional quality checks might miss, reinforcing the importance of real-time validation in strategic decision-making.

Unvalidated AI outputs can lead to inconsistencies in planning, creating risks for organizations [2]. By covering all data, AI ensures that executives always work with reliable, verified information.

Lower Costs and Better Resource Use

Beyond speed and accuracy, AI-driven validation significantly reduces costs and optimizes how resources are used. By catching problems early, AI prevents costly errors and avoids the need for extensive rework. For instance, organizations using AI-powered monitoring systems have seen a 50–60% reduction in median fraud losses, with losses dropping from over $200,000 to approximately $100,000–$120,000 [3].

But the real value lies in how AI frees up human expertise. Instead of spending weeks on manual tasks like gathering audit evidence or validating data, consultants and strategists can focus on more impactful, advisory work. As Jason Norman, Founder and CEO of Executive AI Partners, explains:

A $100K market research error caught by $10K in validation interviews delivers 10x return. A $500K strategic misstep prevented by systematic validation is career-saving.

AI Academy: Episode 3 – Automated Data Validation and Smart Routing

AI Techniques Behind Real-Time Validation

Advancements in detection and data integrity have paved the way for three key AI techniques that enhance real-time validation. These methods are designed to catch errors before they can disrupt critical decision-making processes.

Machine Learning for Pattern Recognition

Machine learning models play a critical role in identifying what constitutes "normal" by analyzing historical data patterns. They flag anomalies like sudden shifts in data structure, unexpected drops in volume, or unusual language patterns - issues that manual reviews often overlook [6]. For unstructured data, Natural Language Processing (NLP) models step in to analyze content from sources like news articles, regulatory filings, and job postings, extracting actionable insights that support strategic due diligence [5].

Unsupervised anomaly detection is particularly useful here, as it creates statistical benchmarks to identify deviations early, preventing them from skewing executive dashboards. Interestingly, even AI models can demonstrate consistency rates as low as 29.9% when evaluating identical business scenarios, depending on how questions are framed [2].

Predictive Analytics for Risk Forecasting

Predictive analytics takes validation a step further, shifting the focus from reactive assessments ("What went wrong?") to proactive insights ("What might go wrong?") [3]. These models are adept at identifying data drift and model pollution, alerting teams to subtle changes before they disrupt production systems [1][6]. They also analyze historical cases to uncover failure modes, identifying scenarios where an opportunity might falter despite promising initial data [2].

The impact of these models is tangible. Organizations using continuous monitoring controls have seen a 50-60% reduction in median fraud losses, with figures dropping from over $200,000 to around $100,000-$120,000 [3]. Predictive analytics also powers risk simulations, where AI generates the strongest counterarguments against a strategic opportunity. These simulations highlight specific, data-driven failure scenarios that traditional methods might miss [2].

In tandem with predictive insights, automated data cleansing ensures that only high-quality data is used downstream.

Automated Data Cleansing and Standardization

Automated data cleansing tackles errors at the point of ingestion. Tools like Schema Registry enforce predefined data structures, quarantining misformatted records immediately [4][7]. Beyond structural checks, AI applies business rules using platforms like Apache Flink to detect issues such as out-of-range values, missing identifiers, or abnormal spikes [4].

A real-world example of this approach is Siemens Healthineers, which uses Confluent to manage its technology lifecycle - from manufacturing to hospital installations. Their system processes 8 million messages daily, enabling instant identification of manufacturing defects and ensuring accurate diagnostic results for patients worldwide [4]. The results are impressive: AI-driven validation delivers 98% data accuracy and detects errors 90% faster than manual processes [7]. Flagged records are set aside for manual review, maintaining clean production pipelines while preserving problematic data for further analysis [4][6]. This automated process not only safeguards data integrity but also supports reliable, AI-driven strategic planning. For more expert tips and frameworks on implementing these technologies, explore our latest business innovation guides.

StratEngineAI: Real-Time Validation in Action

AI-Powered Validation Across 20+ Frameworks

StratEngineAI leverages real-time AI monitoring to revolutionize strategic planning. By applying validation protocols across a wide range of frameworks - like SWOT analyses and Porter's Five Forces - it tackles a pressing issue: AI models can produce conflicting evaluations nearly 19% of the time, even with advanced systems like GPT-4 Turbo [2].

The platform employs a tiered validation system tailored to the financial stakes involved. For example, Tier 3 validation includes bias stress tests for every recommendation, while Tier 1 validation - featuring expert interviews - ensures 85-95% confidence in decisions involving impacts exceeding $100,000 [2]. This meticulous process provides the reliability needed for high-stakes decisions. Jason Norman, Founder/CEO of Executive AI Partners, emphasizes this point:

AI's confidence doesn't equal AI's accuracy. The path to trustworthy AI strategy is methodological validation.

With this framework, StratEngineAI ensures that strategic documents and investment memos meet the rigorous standards expected by C-suite executives and investment committees.

Faster Strategic Planning with Verified Data

Real-time validation enables what engineers call a "shift left" approach, which identifies data errors early - before they affect financial models or executive dashboards [4]. The impact is tangible. For instance, an August 2025 case study showed that AI-powered research reduced project timelines from 7-10 days to under one day, while also increasing signal coverage by 30% [5].

StratEngineAI achieves similar efficiencies without compromising data quality. For example, catching a $100,000 market research error through $10,000 in validation interviews yields a 10x return on investment [2]. Unlike traditional methods that rely on limited samples or periodic reviews, StratEngineAI continuously processes 100% of data signals in real-time [3]. This comprehensive approach allows consultants and venture capitalists to focus on strategic analysis rather than spending excessive time verifying data quality.

By combining speed with accuracy, StratEngineAI not only accelerates planning but also strengthens accountability through its traceable processes.

Transparent and Traceable Validation

StratEngineAI ensures every validation decision is fully traceable, meeting the transparency standards required for high-level analysis. The platform employs inversion testing, asking AI to generate the strongest counterarguments to a strategic opportunity. This method uncovers hidden risks that conventional approaches might overlook [2]. Additionally, invalid data is routed to dead-letter queues for further review, keeping pipelines clean while retaining problematic records for investigation [4].

Organizations using AI-driven continuous monitoring have reported a 50-60% reduction in median fraud losses [3]. For strategic planning and due diligence, this same level of rigor leads to fewer costly mistakes and more robust recommendations. These recommendations not only hold up under boardroom scrutiny but also maintain the data integrity and strategic depth required for executive decision-making.

Conclusion

Real-time AI validation monitoring is reshaping how organizations manage strategic planning and ensure data integrity. Traditional manual methods often identify errors only after they've disrupted downstream systems. In contrast, AI-powered systems act as gatekeepers, stopping bad data right at the source before it spreads [4]. This proactive approach is critical, especially when poor data quality costs organizations an average of $12.9 million annually [1]. Companies using continuous monitoring have reported a 50–60% reduction in median fraud losses [3], unlocking substantial savings and enabling quicker, more confident decision-making.

Beyond cost savings, AI-powered validation equips executives to make high-stakes decisions with greater confidence. AI’s ability to detect subtle anomalies - such as shifts in categories or changes in language patterns - far surpasses the scope of manual checks [1][6]. By implementing tiered frameworks that align validation rigor with financial risk, organizations can achieve 85–95% confidence in critical decisions [2]. With tools like automated pattern recognition, predictive analytics, and transparent audit trails, companies can elevate their strategic planning processes to meet boardroom expectations - without the extended delays of traditional methods.

This isn't just about catching errors faster. It's about fundamentally changing how organizations approach strategic planning by turning data quality from a periodic task into a continuous, competitive advantage.

FAQs

What data should be validated in real time first?

Prioritizing critical, high-impact data for real-time validation is essential. This means focusing on areas like market data, financial metrics, and internal performance indicators. Ensuring these data points are accurate allows for dependable decision-making and minimizes the risk of errors.

How do AI monitors detect silent data drift?

AI monitors keep an eye on data in real time, spotting subtle changes that might otherwise go unnoticed. By analyzing data continuously, they can detect inconsistencies and predict potential problems early on. This proactive approach not only identifies errors but also automates their correction, helping maintain accurate and dependable datasets.

What’s needed to make validation results audit-ready?

To make sure validation results can stand up to audits, gather physical measurements or market intelligence, cross-check data to spot any biases, and present clear proof of data quality. This method not only supports governance and regulatory standards but also ensures the data is accurate and dependable.