How VCs Use Predictive Analytics for Deal Flow

How VCs use AI-driven predictive models to screen pitch decks, track signals (GitHub, patents, hiring), reduce bias, and speed up deal sourcing and due diligence.

Jan 16, 2026

Predictive analytics is transforming venture capital by helping firms manage overwhelming deal flow with precision and speed. By leveraging AI and machine learning, VCs can now identify promising startups earlier, automate pitch deck screening, and reduce bias in decision-making. Here's how it works:

Data-Driven Insights: Predictive models analyze unconventional data like GitHub activity, patent filings, and hiring trends to spot early growth signals.

Automated Screening: AI tools sift through thousands of pitch decks, scoring startups against investment criteria and saving up to 60% of due diligence time.

Benchmarking & Forecasting: Advanced models evaluate startups using metrics like revenue growth, founder expertise, and IP strength, while forecasting future success probabilities.

Market & Competitor Tracking: AI monitors trends and competitor moves through real-time data, enabling VCs to act faster on emerging opportunities.

Bias Reduction: Standardized scoring and "blind" due diligence processes help eliminate unconscious bias, ensuring fairer evaluations.

The result? Faster decisions, better deal sourcing, and improved portfolio outcomes. By 2025, over 75% of VC reviews are expected to incorporate AI insights, marking a shift toward more efficient, data-driven investment strategies.

Data Analytics and Technology is Reshaping Private Equity Deal Sourcing. Don't Be Left Behind!

Building Data Pipelines for Deal Sourcing

Predictive analytics in venture capital hinges on creating efficient data pipelines that automatically gather, process, and analyze startup signals. This setup transforms how venture capitalists (VCs) identify opportunities, shifting from reactive inbox management to a proactive, data-driven approach. These pipelines form the backbone of predictive insights, enabling VCs to make faster, more informed decisions. By integrating external signals (like market trends and company data), internal signals (such as CRM activity and outcomes), and an AI layer powered by large language models, these systems capture a wealth of information. The next section dives deeper into the specific data sources that power these predictive models, offering actionable insights on AI strategy for modern investment firms.

A prime example of this approach is Signalfire’s proprietary "Beacon" platform, unveiled in March 2021. This San Francisco-based venture firm uses Beacon to track over 6 million companies, pulling from 10 million data sources, including academic papers, patent filings, open-source contributions, regulatory documents, and raw credit card data. Maintaining this system costs over $10 million annually, but it allows the firm to flag high-potential companies on a dedicated dashboard [3].

Data Sources for VC Prediction Models

Successful venture capital prediction models rely on diverse and often unconventional data sources to detect early signs of startup momentum. Beyond the usual suspects like LinkedIn and Crunchbase, these pipelines tap into unique signals, such as GitHub activity to measure technical progress, niche job postings to gauge hiring trends, and patent filings to assess intellectual property strength. Some systems even incorporate raw credit card and sales data to track real-time revenue growth.

Advanced models go a step further, analyzing linguistic patterns in founders’ communications - whether through blogs, research papers, or public statements - to identify innovative thinking and domain expertise. These tools also scrape niche forums like Reddit and Discord to capture early-adopter sentiment, long before it becomes mainstream. Additionally, graph neural networks map professional networks, scoring startups based on the technical strength of their collaborators.

Data Category | Specific Sources | Predictive Signal |

|---|---|---|

Firmographic | Funding events, leadership changes, company size | |

Technical | GitHub, Patent Registries, Research Papers | Code development speed, IP strength, technical innovation |

Market | Reddit, Discord, News, Regulatory Filings | Early-adopter feedback, competitor insights |

Operational | Job Boards, Company Websites | Hiring activity, growth trends, geographic expansion |

Financial | Credit Card Data, Sales Data, CRM | Revenue growth, acquisition efficiency |

Automating Startup Screening

With such a rich set of data, automation tools can match startups to specific investment criteria with remarkable precision. Machine learning models, for example, use natural language processing (NLP) to extract valuable insights from unstructured sources like founder interviews or technical blogs. Algorithms such as XGBoost then score startups based on how well they align with an investor’s thesis.

The key to success lies in adopting a modular, industry-specific approach rather than a one-size-fits-all model. Different industries prioritize different signals - a SaaS startup’s growth indicators differ significantly from those of a biotech company. By harmonizing structured and unstructured data using a data fabric approach, these systems minimize bias and adapt to the nuances of each sector. This approach also helps prevent model drift and reduces the risk of perpetuating historical biases. Interestingly, even large funds managing over $5 billion in assets often operate with lean engineering teams of around seven people to maintain these advanced systems [6].

Benchmarking Startups with Prediction Models

After setting up robust data pipelines, the next step involves leveraging predictive models to benchmark startups against industry standards. These models take raw data and transform it into actionable rankings, giving venture capitalists (VCs) a clear, objective way to prioritize investment opportunities. By combining traditional financial metrics with unconventional signals, these models provide a well-rounded view of a startup's potential. This benchmarking process sets the stage for deeper performance analysis in subsequent steps.

This shift represents a move away from subjective decision-making toward a more data-driven approach to evaluating startups [3].

Analyzing Performance Metrics

Predictive models evaluate startups by analyzing a diverse range of metrics, going far beyond basic financial data. Financial indicators such as Monthly Recurring Revenue (MRR), Customer Acquisition Cost (CAC), churn rate, and burn rate offer a snapshot of financial health. What makes these models powerful is their ability to integrate operational indicators like hiring trends, the sophistication of skills in job postings, and the frequency of code commits [1]. Together, these metrics create a comprehensive framework for evaluation.

Intellectual property (IP) metrics add another dimension to the analysis. These models assess factors like the novelty of patent applications, technical defensibility, and the overall strength of a startup's "patent thicket" [1]. Meanwhile, market sentiment is tracked through early adopter discussions on platforms such as Reddit and Discord, competitor pricing trends, and regulatory changes that could influence a startup's trajectory [1].

Another fascinating layer is the analysis of founders and their teams. Advanced models evaluate linguistic patterns in public materials - blogs, research papers, and interviews - to spot evidence of strategic thinking and vision. Additionally, professional networks are mapped using graph analysis, assigning scores based on the technical expertise and influence of collaborators and endorsers [1].

Metric Category | Specific Metrics Analyzed |

|---|---|

Financial | Revenue growth, burn rate, MRR, ARR, CAC, churn rate |

Operational | Hiring velocity, skill sophistication in job postings, code commit frequency |

Intellectual Property | Patent novelty, technical defensibility, patent thicket strength |

Market/Sentiment | Early-adopter sentiment, competitor pricing, regulatory changes |

Founder/Team | Linguistic patterns, professional network mapping, digital endorser influence |

These models have demonstrated impressive accuracy. For instance, an XGBoost predictive model outperformed the average venture capitalist by 25% in screening startups [4]. One VC firm even reported a 60% reduction in due diligence time after adopting an AI-driven platform [4].

Forecasting Startup Success

Predictive models don't just assess current performance - they also forecast a startup's future success. Using survival analysis, a method borrowed from medical research, these models estimate both the likelihood and timing of key liquidity events, such as acquisitions or IPOs [1]. This allows VCs to better manage capital lock-up periods and refine portfolio strategies. By building on current metrics, these forecasting tools extend the evaluation into probabilities of future success.

Anomaly detection is another critical feature. This technique identifies startups that, while unconventional, show strong signs of innovation and market traction [1]. These algorithms help VCs avoid the common pitfall of overlooking disruptive opportunities simply because they don't fit traditional patterns.

The most advanced platforms use Bayesian inference to update success probabilities in real time as new data becomes available. For example, a sudden increase in GitHub activity, a high-profile hire, or the emergence of a new competitor can dynamically adjust a startup's ranking [1]. This continuous updating ensures that benchmarks remain relevant, even in rapidly changing markets.

To gain the trust of investment committees, modern systems focus on explainable AI (XAI). Instead of producing opaque "black box" outputs, these systems break down the contribution of each factor - such as showing that "40% of this startup's score comes from high-velocity patent filings" [1]. This transparency allows investors to audit the reasoning and make informed decisions, even overriding predictions when qualitative insights warrant it.

One cutting-edge approach is "blind" due diligence, where success scores are generated before investors meet the founders. This method minimizes unconscious bias, requiring partners to provide clear evidence if they decide to deviate from the data-driven rankings [1].

Using Predictive Analytics for Market and Competitor Analysis

Predictive analytics isn't just reshaping how startups are evaluated - it’s also revolutionizing how markets and competitors are analyzed. By leveraging this data-driven approach, investors can track market trends and competitor movements with precision, uncovering opportunities and timing investments more effectively. This strategy shifts venture capitalists (VCs) away from traditional lagging indicators like revenue reports and media buzz, focusing instead on early signals that often go unnoticed.

Monitoring Market Trends

Predictive tools are particularly adept at spotting market momentum before it becomes widely recognized. Instead of waiting for industries to gain traction in mainstream media, these systems analyze leading indicators such as patent filings, GitHub activity, and niche job postings [1][3]. For instance, a notable uptick in job postings for specialized AI researchers, rather than general developers, can signal a company’s technical direction and plans for scaling [1].

Another key element is market sentiment analysis. AI-powered tools monitor early adopter discussions on platforms like Reddit, Discord, and specialized forums to gauge excitement around emerging technologies or business models [1]. This approach can reveal product-market fit well before it’s highlighted in traditional media. Tools that analyze global patent applications using natural language processing (NLP) also help investors identify risks like "patent thickets" or freedom-to-operate challenges [1].

Platforms such as Signalfire’s proprietary system showcase how tracking millions of companies through diverse data streams enables investors to identify opportunities earlier than conventional methods [3].

Tracking Competitor Activity

While tracking market trends highlights emerging opportunities, keeping an eye on competitors sharpens investment timing. This requires processing vast amounts of unstructured data. NLP models, for example, sift through thousands of news articles, annual reports, and technical papers to create real-time competitive matrices and strategic briefs to assess market opportunities [1][7]. These systems can identify disruption indicators, such as sudden pricing changes or shifts in marketing strategies by established players, which often point to activity from stealth-mode startups [1].

Automated alerts further enhance this process. A competitor’s sudden spike in patent filings, a key executive hire from a major tech company, or a shift in product messaging can signal potential market disruptions [1]. By continuously monitoring these signals, rather than reviewing them periodically, VCs can act more decisively and with better timing.

The adoption of these methods is accelerating. By 2025, over 75% of venture capital and early-stage investment reviews are expected to rely on AI and data analytics [3]. In 2024 alone, 88% of companies reported using AI in at least one business function, up from 78% the previous year [4]. This growing reliance on AI reflects a fundamental transformation in how VCs gather intelligence and make critical investment decisions.

Automating Pitch Deck Screening and Investment Memos

Venture capital (VC) firms face an overwhelming challenge: reviewing thousands of pitch decks every year. This process eats up a significant amount of analysts' time, leaving less room for focusing on promising opportunities. Enter predictive analytics, which streamlines the initial screening process and helps generate structured investment memos. By automating these steps, firms can slash due diligence time while maintaining high evaluation standards. This shift frees investment teams to prioritize deals with real potential instead of getting bogged down in administrative tasks.

Scoring Pitch Decks Automatically

AI-powered scoring systems are changing the game by evaluating pitch decks against 50+ startup metrics simultaneously [7]. These systems rely on multiple large language models to extract insights from unstructured content. They analyze everything from the way founders communicate their vision to metrics like hiring speed and open-source code contributions [1]. The outcome? An objective success score that filters out 80-90% of unsuitable deals based on factors like poor sector alignment, weak intellectual property filings, or mismatched valuations [1].

A great example of this in action comes from October 2023, when Haje Jan Kamps tested an AI review tool on BusRight's pitch deck. BusRight, a startup that had already raised $7 million, received a detailed analysis. The AI flagged that the CEO lacked direct experience in municipal services but noted the company’s traction slide effectively made up for this shortfall. It also identified missing elements, such as a "use of funds" slide and competitor analysis - points that matched critiques from human experts [8]. This automated triage saved over an hour of manual review time per pitch deck [7][5].

Consistency is another key benefit. By using standardized scoring systems - like categories rated from 350 to 850 or dimensions graded out of 10 - AI ensures evaluations are uniform and free from personal bias [9]. Once the scoring is complete, the AI produces detailed investment memos to complete the initial review process.

Generating Investment Memos with AI

After a pitch deck clears the initial screening, AI steps in to streamline the creation of structured, traceable investment memos. These memos summarize key metrics, flag inconsistencies, and suggest follow-up questions, creating a clear and auditable decision-making process for investment committees [4]. Advanced platforms use Retrieval-Augmented Generation (RAG) to combine unstructured data - like news articles or founder interviews - with structured data, such as financials and cap tables. This approach delivers deeper insights and opportunity scores [5].

Transparency is a critical element here. Explainable AI (XAI) tools break down the weighted contributions of various factors - like patent velocity accounting for 40% or hiring momentum for 25% - so partners can see exactly how a startup's score was calculated [1]. This "blind" due diligence process ensures decisions are based on data, not personal biases like affinity or confirmation bias [1]. In fact, partners now have to justify any decision that deviates from the AI’s data-driven insights.

The time savings are impressive. One VC firm reported cutting due diligence time by 60% after adopting an AI platform [4]. Tools like StratEngineAI (https://stratengineai.com) automate both pitch deck screening and investment memo generation, delivering institutional-grade analysis in minutes instead of weeks. As the industry moves toward more autonomous systems capable of managing entire due diligence workflows [4][6], firms that embrace these tools gain a competitive edge by evaluating more deals faster, without compromising analytical depth.

Adding Predictive Analytics to Your VC Workflow

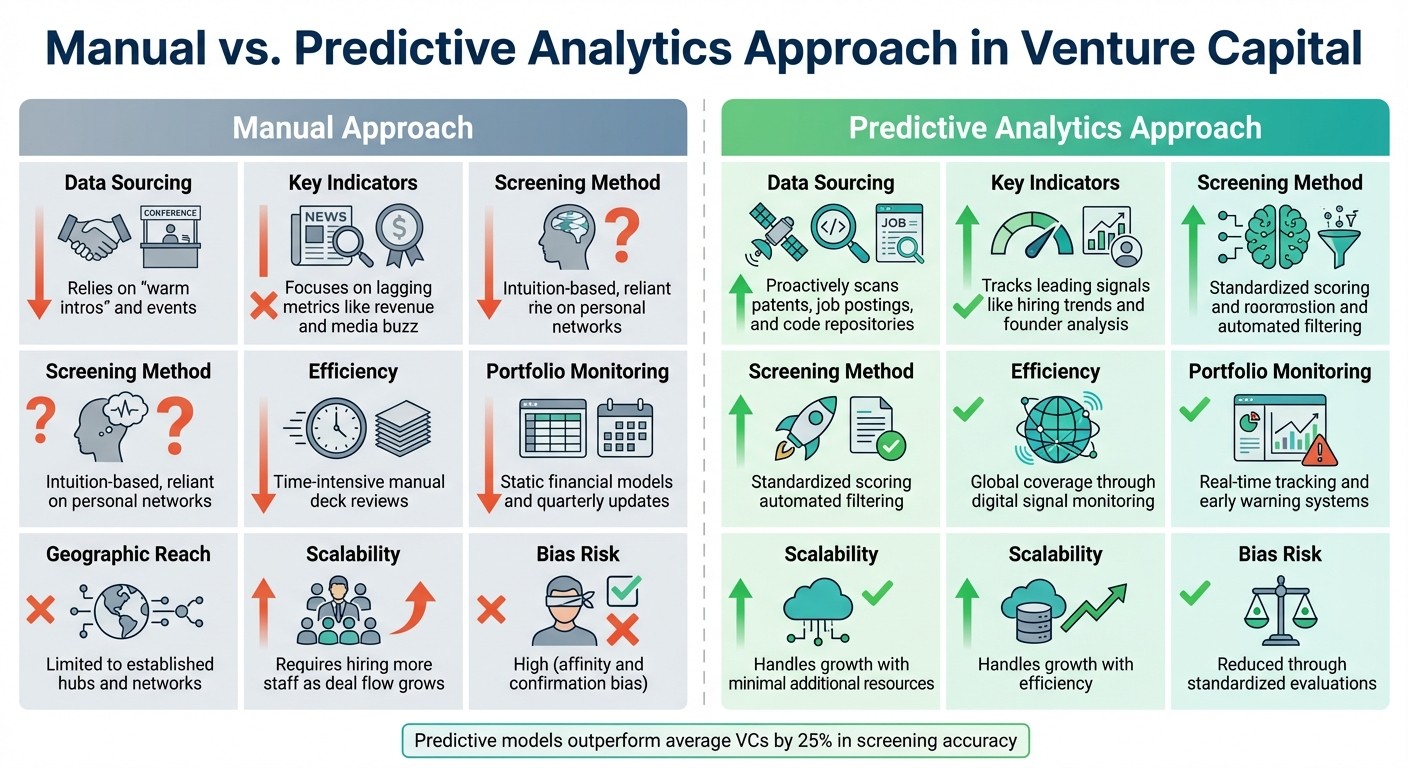

Manual vs Predictive Analytics in Venture Capital: Key Differences

Bringing predictive analytics into your venture capital process doesn't have to be overwhelming. Take it step by step. Start by automating tasks like sourcing and screening deals, and then gradually introduce it to other areas such as diligence document review and portfolio tracking [5]. This incremental approach keeps things manageable while delivering noticeable improvements at each stage.

The first step? Define a clear AI strategy that aligns with your investment goals [2].

"The role of AI tools in venture capitalism boils down to two primary goals: increasing operational efficiency and generating alpha." - Mohammad Rasouli, AI Researcher and Consultant at Stanford University [2]

Before diving into tools, decide what you want to achieve. Are you aiming to filter out unsuitable deals faster? Spot stealth startups earlier? Or maybe reduce unconscious bias in your screening process? Having a clear goal ensures the tools you choose actually meet your needs.

Once your strategy is in place, focus on the technical setup. Connect predictive tools to your CRM and deal management systems using APIs and connectors. At the same time, establish strong data quality policies [2][7][5].

"Data is the lifeblood of AI solutions. It allows AI systems to learn, adapt and make proper decisions... it's important to establish robust policies and measures that ensure that only high-quality, accurate data is fed into these AI systems." - Artur Haponik, CEO & Co-Founder of Addepto [2]

While AI handles the heavy lifting, keep humans in the loop. Successful implementations combine the efficiency of predictive models with the qualitative insights only people can provide [2][7]. Use AI for tasks like quantitative triage and pattern detection, and rely on tools like Explainable AI (XAI) to show how decisions are made [1]. This transparency builds trust with investment committees and helps partners understand the rationale behind recommendations.

Platforms like StratEngineAI (https://stratengineai.com) make this process even smoother. They integrate tasks like pitch deck screening and investment memo creation into a single workflow, letting firms analyze more deals in less time without compromising on depth.

Benefits of Workflow Automation

Adding predictive analytics to your workflow doesn’t just save time - it transforms how your team operates. One of the biggest wins? Reducing manual effort. AI can automatically filter out 80–90% of unsuitable inbound deals by analyzing factors like sector alignment, intellectual property strength, or valuation mismatches [1][4]. This frees up partners to focus on high-potential opportunities instead of slogging through endless pitch decks.

Another game-changer is speed. Faster decision-making gives you a competitive edge. In 2024, 88% of companies reported using AI in at least one business function, up from 78% the year before [4]. This rapid adoption shows how essential AI has become across industries.

AI also addresses a long-standing issue in venture capital: unconscious bias. Traditional methods often favor founders with similar backgrounds, which can cause investors to overlook exceptional talent from nontraditional paths [1]. Predictive analytics ensures a more standardized, data-driven evaluation process, helping to reduce affinity and confirmation bias [4]. For example, generating AI-based success scores before meeting founders can create a "blind" due diligence process, shielding evaluations from subjective judgments [1].

Another key advantage is scalability. With AI, firms can handle significantly more deal flow without needing to grow their team proportionally [2]. Data-driven companies are already seeing three times higher revenue per employee compared to those without similar tools [4]. In fact, a third of these firms now generate over 40% of their deal flow through automated systems [6].

Finally, predictive models enhance signal detection, tracking early indicators like hiring trends, open-source code contributions, and patent filings. These signals often surface months - or even years - before traditional metrics like revenue growth or media buzz [1]. For example, an XGBoost screening model outperformed the average venture capitalist by 25% in deal performance [4]. This shows that predictive systems can improve not only efficiency but also investment outcomes.

Manual vs. Predictive Approaches

The table below highlights the stark differences between traditional methods and predictive analytics:

Feature | Manual Approach | Predictive Analytics Approach |

|---|---|---|

Data Sourcing | Proactively scans patents, job postings, and code repositories [1] | |

Key Indicators | Focuses on lagging metrics like revenue and media buzz [1] | Tracks leading signals like hiring trends and founder analysis [1] |

Screening Method | ||

Efficiency | Time-intensive manual deck reviews [1] | Rapid filtering and summarization [4] |

Geographic Reach | Limited to established hubs and networks [1] | Global coverage through digital signal monitoring [1] |

Portfolio Monitoring | Static financial models and quarterly updates [1] | Real-time tracking and early warning systems [1] |

Scalability | Requires hiring more staff as deal flow grows [2] | Handles growth with minimal additional resources [2] |

Bias Risk | High (affinity and confirmation bias) [1] | Reduced through standardized evaluations [4] |

One of the biggest shifts with predictive analytics is moving from passive to proactive sourcing. Traditional methods rely on pitch decks arriving through personal introductions or events, which limits deal flow to existing networks. Predictive tools, on the other hand, actively scan global markets, identifying promising startups that may not yet be on anyone’s radar. This is especially valuable for firms aiming to invest in underrepresented founders or emerging markets outside of traditional tech hubs.

Another major change is the shift from lagging to leading indicators. By the time a startup shows strong revenue or media coverage, its valuation has often skyrocketed, and competition for investment is fierce. Predictive analytics enables firms to identify high-potential startups earlier - when valuations are still reasonable - by tracking early signals like hiring patterns, code commits, and patent activity [1]. This gives firms a chance to build relationships and secure deals before the broader market catches on.

Conclusion

Main Takeaways

The integration of predictive analytics is reshaping how venture capital firms source, evaluate, and manage investments. By cutting due diligence time by up to 60%, this technology allows firms to handle more deals without needing to expand their teams proportionally. This means partners can focus their energy on pursuing high-potential opportunities instead of getting bogged down in time-consuming processes [4].

Predictive models offer a critical edge by identifying early signals that traditional methods often miss. Instead of relying on lagging indicators like revenue or media buzz, AI leverages data points such as hiring trends, patent activity, and contributions to open-source projects. These signals often surface months - or even years - before a startup becomes widely recognized [1]. For example, an XGBoost predictive model has been shown to outperform the average venture capitalist by 25% in screening accuracy [4].

Beyond efficiency, this technology addresses some of the industry's long-standing challenges, such as bias and scalability. By standardizing the evaluation process with data-driven scoring, AI helps reduce unconscious biases that can favor founders from familiar backgrounds, making evaluations more equitable [1][4]. Additionally, about one-third of data-driven VC firms now generate over 40% of their deal flow through automated systems. This shows how AI enables firms to expand their reach beyond traditional startup hubs without compromising on deal quality [6].

These advancements are paving the way for the next chapter in venture capital.

The Future of AI in Venture Capital

The venture capital world is on the brink of a major shift. Andre Retterrath has dubbed this the "year of agents", where AI systems evolve from being mere tools to fully autonomous workflow systems [6]. By 2025, it's expected that over 75% of executive reviews in venture capital will rely on insights from AI and data analytics, fundamentally changing how investment decisions are made [3].

"The future of venture capital won't be won by those who talk about AI - it'll be won by those who build with it." - Andre Retterrath, Founder of Data Driven VC [6]

This shift aligns with what Rahul Sharma refers to as the "Quant-Venture Fund" model. This hybrid approach combines human expertise with the scalable, unbiased power of predictive analytics [1]. Tools like StratEngineAI (https://stratengineai.com) are already enabling firms to streamline processes like pitch deck analysis and investment memo creation, turning weeks of work into mere minutes. The firms that truly stand out will be those that not only adopt cutting-edge algorithms but also leverage unique, proprietary data sources to gain a competitive edge [1].

The future of venture capital lies in this blend of human insight and AI-driven precision, setting the stage for an era of smarter, faster, and more inclusive investment strategies.

FAQs

How can predictive analytics help venture capitalists discover high-potential startups faster?

Predictive analytics gives venture capitalists the ability to sift through massive amounts of both structured and unstructured data - think patents, social media activity, job listings, and startup platforms like Crunchbase or PitchBook. By leveraging machine learning (ML) and natural language processing (NLP) models, these tools can pinpoint early signs of success, such as market momentum, potential for innovation, or team expansion. This makes it easier and faster for VCs to spot high-potential startups.

What’s more, predictive analytics automates much of the screening process. This not only cuts down on the time and effort spent manually evaluating opportunities but also reduces biases tied to location or personal networks. By applying consistent evaluation standards, investors can zero in on the best opportunities and make quicker, data-backed decisions without sacrificing thoroughness.

What types of unconventional data do VCs use in predictive analytics?

Venture capitalists are turning to unexpected data sources to fine-tune their predictive models and make sharper investment decisions. Beyond the usual metrics like financial reports or market size, they’re digging into real-time signals such as patent filings, activity on open-source platforms, social media buzz, and even niche job postings.

These unconventional data points can uncover early indicators of a startup’s technical breakthroughs, community involvement, or hiring trends - things that traditional datasets often miss. By weaving these insights into their models, investors can cut down on bias, evaluate founders more effectively, and zero in on the most promising opportunities in a sea of potential deals.

How does predictive analytics help venture capitalists make fairer investment decisions?

Predictive analytics is changing the game for venture capitalists by shifting the focus from gut feelings to data-backed decision-making. Instead of relying on personal connections or proximity to certain geographic hubs, these models use extensive, objective metrics to evaluate startups.

By honing in on quantifiable factors, predictive analytics helps counteract common cognitive biases, like favoring industries or founders that feel familiar. This creates a more consistent and fair evaluation process, ultimately leading to smarter and more informed investment choices.